Tips on International Money Exchange for Travelers

Whether you’re a solo backpacker, digital nomad, business traveler, or planning a family vacation abroad, managing money efficiently while traveling is crucial. Between fluctuating exchange rates, hidden ATM fees, and the temptation of tourist traps, a bit of smart planning goes a long way.

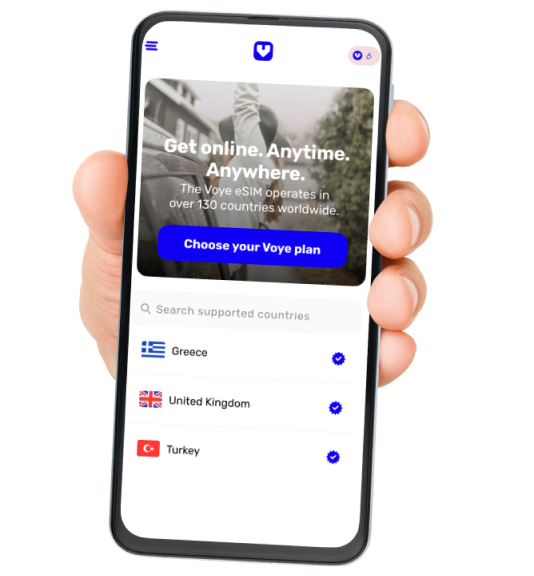

This guide shares practical, up-to-date international money exchange tips, helping you save money, avoid common pitfalls, and stay financially secure. And while you’re managing your finances, staying connected should be part of the plan—not through risky public Wi-Fi, but through safe, high-speed eSIMs from trusted providers like Voye Global.

General Money Exchange Tips for All Travelers

1. Avoid Currency Exchange at Airports

Airport kiosks are convenient but often charge high fees and offer poor exchange rates. Exchange small amounts only if necessary and look for better rates in city centers or use ATMs.

2. Use ATMs Strategically

ATMs typically offer better exchange rates than currency exchange counters, but fees can add up. Use machines:

- Affiliated with major banks.

- That support your card’s international network (e.g., Visa, Mastercard, Cirrus).

- Located in secure areas like banks or malls.

Pro Tip: Withdraw larger amounts to reduce frequency and minimize per-transaction fees.

3. Opt for No-Foreign-Transaction-Fee Cards

Credit and debit cards that waive foreign transaction fees can save you 2–3% on every purchase. Popular travel-friendly cards include those from Wise, Revolut, or major international banks.

4. Always Pay in Local Currency

When offered the choice at point-of-sale terminals, choose to pay in local currency, not your home currency. This avoids Dynamic Currency Conversion, which usually comes with inflated rates.

5. Carry Multiple Payment Options

Having:

- One credit card (for major purchases and hotel bookings),

- One debit card (for cash withdrawals),

- A small amount of local currency (for tips, taxis, or street vendors),

ensures you’re prepared for any situation.

Tips for Digital Nomads

Digital nomads often deal with multi-currency payments, variable incomes, and longer stays in foreign countries. Here’s how to manage money better:

1. Use Multi-Currency Accounts

Apps like Wise and Revolut let you hold, send, and convert multiple currencies at real exchange rates. Ideal for receiving payments in one currency and spending in another.

2. Watch Currency Trends

Keep an eye on foreign exchange markets to exchange money when the rates are favorable. Even a 2% difference in exchange rate can save you hundreds over time.

3. Budget for Variable Income

Set up a core monthly budget based on your lowest average income month to ensure you always meet your financial obligations.

Your Journey, Our eSIM

Stay online abroad with instant activation.

Tips for Business Travelers

Traveling for work? Efficiency and clarity are key.

1. Use a Business Credit Card

Corporate cards often include:

- Expense tracking tools,

- Complimentary travel insurance,

- Airport lounge access.

Plus, it keeps personal and professional expenses separate.

2. Maintain Clear Expense Logs

Track every meal, ride, or hotel stay. Use apps like Expensify or Concur to snap receipts and generate reports instantly.

3. Consider Prepaid eSIMs Over Roaming

International roaming costs can balloon quickly during business trips. Opt for a prepaid eSIM for high-speed internet and real-time expense reporting, call scheduling, or document access on the go.

Tips for Families Traveling Internationally

Family trips need extra planning—especially with kids.

1. Create a Daily Budget

Keep things under control by assigning a daily allowance for food, entertainment, and shopping. It adds predictability and reduces unnecessary overspending.

2. Convert Currency in Advance

Having local currency handy for snacks, cabs, and tips is useful. Don’t rely on exchanging money last minute.

3. Teach Kids Basic Currency Skills

Involve children in paying for small items. It’s a great way to teach money handling and makes them feel engaged.

Safe Connectivity for Managing Money on the Go

Whether you’re:

- Checking exchange rates,

- Logging into banking apps,

- Transferring funds,

- Or using travel budgeting tools,

you need a secure internet connection.

Avoid using public Wi-Fi, especially for financial transactions. Public networks are often unencrypted and vulnerable to cyberattacks.

The Solution? Travel with an eSIM

A travel eSIM from a reliable provider gives you:

- High-speed 4G/5G internet on your smartphone or tablet.

- Secure, encrypted connection when handling money online.

- Instant setup—no SIM cards, no waiting.

Why Voye Global is the Smart Choice for Travel Connectivity?

Voye Global is a leading provider of prepaid international eSIMs with service in 150+ countries. Whether you’re working remotely from Bali, visiting vineyards in Portugal, or hiking in Patagonia, Voye Global ensures you’re never disconnected.

Benefits of Voye Global eSIMs:

- Instant activation—Get online within minutes.

- No roaming fees—Predictable prepaid pricing.

- No physical SIMs—Everything is managed virtually.

- Excellent global coverage—From Japan to Jamaica.

- Supports major devices—iPhones, Samsung, Google Pixel & more.

Stay connected securely while:

- Accessing your mobile banking,

- Navigating money exchange apps,

- Receiving payment notifications in real time.

Ready to Travel Smarter?

No matter your destination or travel style, managing your money doesn’t have to be complicated. From currency tips to safe and affordable internet access, the right strategies can help you focus on what really matters—enjoying your journey.

Start your trip right. Stay connected with a Voye Global eSIM.

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.