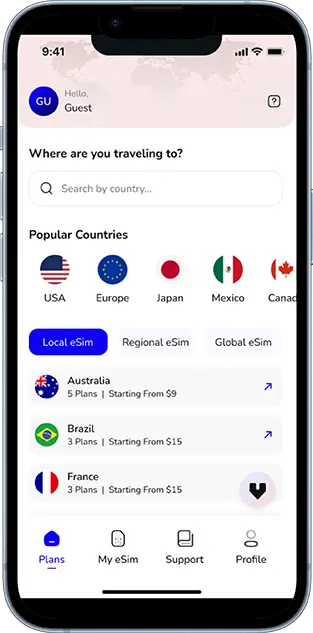

Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

Navigating foreign currency is an essential part of international travel. While credit cards are widely accepted in many places, having local cash is often necessary for small purchases, local markets, transportation, or in areas where card payments aren’t common. But how do you get that local currency without losing a significant chunk of your travel budget to unfavorable rates and hidden fees? Understanding the best way to exchange currency abroad is key to smart currency exchange travel.

This guide will walk you through how to get local currency when traveling, highlighting the most advantageous methods and warning you about the ones that will cost you the most. We’ll provide crucial local currency travel tips, discuss travel money tips for avoiding high currency exchange fees, and help you decide between options like prepaid travel cards vs cash. Get ready to learn the cheapest way to get foreign currency and make the most of your travel funds.

The Best Ways to Get Local Currency Abroad

These methods generally offer the most favorable exchange rates and lowest fees:

1. Using Your Debit Card at Local ATMs

For most travelers, this is the best way to exchange currency abroad. ATMs abroad typically use wholesale exchange rates, which are very close to the actual market rate.

- Tips for Using ATMs Abroad Safely:

* Use ATMs located inside banks or in well-lit, secure areas.

* Cover the keypad when entering your PIN.

* Be aware of your surroundings.

* Notify your bank before you travel to avoid having your card blocked.

* Check if your bank has international ATM partners to potentially waive some fees.

Crucially: When prompted by the ATM, always choose to be charged in the local currency (Dynamic Currency Conversion – DCC). If you choose to be charged in your home currency, the ATM provider will use their own, often unfavorable, exchange rate. This is a major tip for avoiding high currency exchange fees.

2. Using Credit Cards with No Foreign Transaction Fees

While not a way to get cash directly (unless you take a cash advance, which is usually expensive), using a credit card with no foreign transaction fees for purchases is an excellent way to save money. You get a favorable exchange rate, and you avoid the typical 1-3% fee charged by most cards on foreign transactions.

3. Using a Travel-Focused Debit Card or Service (e.g., Wise, Revolut)

Companies like Wise (formerly TransferWise) or Revolut offer debit cards linked to multi-currency accounts. These services often provide excellent exchange rates and low or no fees for ATM withdrawals up to a certain limit, making them a very cheapest way to get foreign currency for frequent travelers.

The Worst Ways to Get Local Currency Abroad

Avoid these methods whenever possible, as they offer poor exchange rates and high fees:

1. Exchanging Currency at Airport Kiosks

This is arguably the worst way to exchange currency abroad. Currency exchange booths at airports know you need local cash immediately and have a captive audience. They offer terrible exchange rates and often charge high fees or commissions. Avoid exchanging large amounts here; only get a small amount if absolutely necessary upon arrival. This clearly demonstrates the difference when you exchange currency at airport vs bank (or ATM).

2. Exchanging Currency at Hotels

Similar to airports, hotels offer convenience but at a significant cost. Their exchange rates are typically very unfavorable compared to banks or ATMs.

3. Exchanging Large Amounts of Cash Before You Leave Home

While it’s wise to have a small amount of foreign currency upon arrival, exchanging large sums at your home bank or a local exchange office before your trip often results in less favorable rates than using ATMs abroad. You’re essentially paying for the convenience.

4. Using Cash Advance on Credit Cards

Taking a cash advance on your credit card abroad is generally very expensive. You’ll likely pay a fee for the transaction, a high interest rate that starts accruing immediately, and potentially foreign transaction fees.

Your Journey, Our eSIM

Stay online abroad with instant activation.

Other Travel Money Tips

- Carry Some Emergency Cash: Despite relying on cards and ATMs, it’s always a good idea to have a small amount of cash in your destination’s currency (obtained via one of the “best” methods) for emergencies or places that don’t accept cards.

- Prepaid Travel Cards vs Cash: Prepaid travel cards can lock in an exchange rate when you load them, which can be good if rates are expected to rise. However, they often have various fees (loading fees, ATM withdrawal fees, inactivity fees). Using a no-foreign-transaction-fee debit card at ATMs is often more flexible and cheaper than a prepaid card. Carrying physical cash always carries the risk of loss or theft.

- Inform Your Bank/Card Providers: Always let your bank and credit card companies know your travel dates and destinations to prevent your cards from being flagged for suspicious activity and blocked.

Avoiding High Currency Exchange Fees: A Summary

To avoid high currency exchange fees:

- Use ATMs with a debit card that has low or no international ATM fees.

- Always choose to be charged in the local currency at ATMs and when paying with a card (avoid DCC).

- Use credit cards with no foreign transaction fees for purchases.

- Consider travel-focused multi-currency accounts/cards.

- Avoid airport and hotel currency exchange kiosks.

- Don’t exchange large amounts of cash before your trip.

Staying Connected for Financial Management

Having reliable mobile data is crucial for managing your money abroad. You’ll need it to find ATMs, check your banking app, monitor transactions, and contact your bank if needed. Avoid expensive international roaming by using an eSIM. Voye Global’s eSIM offers affordable and convenient data plans in numerous countries, ensuring you stay connected for all your travel money tips and needs.

Plan Your Currency Strategy

Getting local currency when traveling doesn’t have to be a costly ordeal. By understanding the best way to exchange currency abroad – primarily using local ATMs with the right debit card and avoiding unfavorable exchange locations – you can significantly reduce fees and get better rates. Implement these local currency travel tips and travel money tips to ensure your focus remains on enjoying your international adventure, not on worrying about expensive currency exchange.

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.

Seamless Mobile Data Everywhere