Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

In recent years, eSIM technology (embedded SIM) has been revolutionizing the way people connect to mobile networks, offering the convenience of digital SIMs over traditional physical SIM cards. While eSIM adoption has been widespread across many countries, regions like China and Hong Kong continue to lag behind in supporting this innovative technology. The lack of widespread eSIM support in China and Hong Kong has sparked questions about the regulatory, technical, and consumer-related challenges preventing its full implementation. In this blog post, we explore the underlying reasons for the limited eSIM availability in these regions, considering both the regulatory hurdles and technical limitations that hinder progress.

What is eSIM technology?

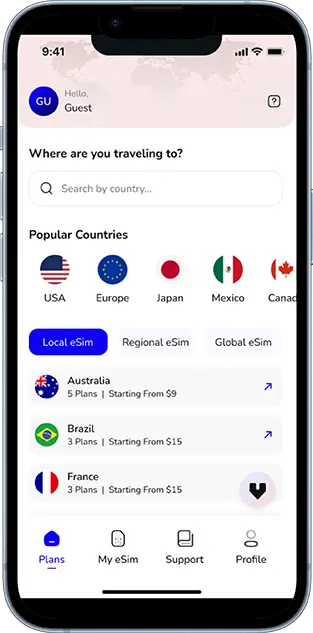

Before diving into the specifics of the challenges in China and Hong Kong, it’s essential to understand what eSIM technology is. Unlike traditional SIM cards, which are physical chips that need to be inserted into mobile devices, eSIMs are embedded directly into devices’ hardware. These digital SIMs allow users to switch mobile carriers, manage multiple phone numbers, and activate mobile plans remotely without needing to handle physical SIM cards. eSIMs provide greater flexibility, security, and the potential for more efficient device design.

However, despite its clear advantages, eSIM technology has encountered slower adoption in China and Hong Kong. Several key factors are at play here, including regulatory restrictions, technical infrastructure challenges, and consumer behavior. Let’s take a closer look at these.

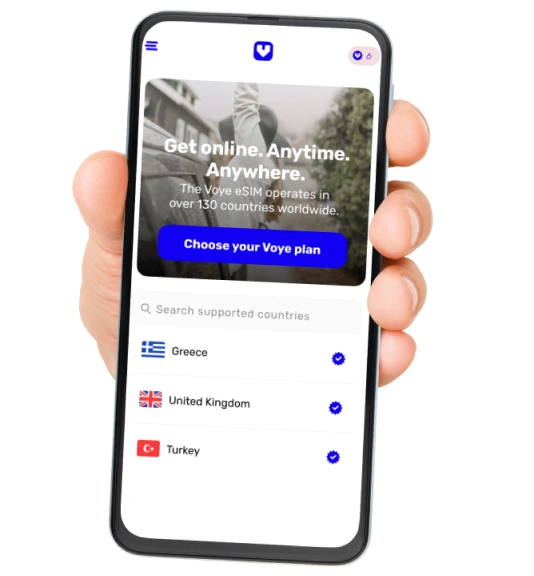

Traveling to anywhere else?

Stay connected effortlessly with Voye Global’s international eSIM plans.

Regulatory challenges in China: why eSIM is delayed

China has long been known for its strict regulatory environment, particularly in sectors like telecommunications. The country’s telecom industry is under the tight control of the government, which heavily influences both the infrastructure and services provided by mobile network operators. This centralized control has helped China make strides in areas like 5G deployment and smart city innovations, but it has also delayed the adoption of emerging technologies like eSIM.

1. Strict telecom regulations

The Ministry of Industry and Information Technology (MIIT) is the government body responsible for overseeing China’s telecommunications industry. Any new technology, especially one that alters how consumers connect to mobile networks, must pass through a rigorous approval process. This means that eSIM technology has to be thoroughly vetted by government regulators before it can be implemented on a national scale.

Telecom providers such as China Mobile, China Telecom, and China Unicom must comply with these regulatory policies. As a result, the eSIM rollout in China is slower than in countries where telecom policies are more liberalized. eSIM adoption is further hindered by the need to modify existing regulatory frameworks to accommodate this new technology.

2. Data privacy and security concerns

China is extremely cautious about data privacy and security, especially when it comes to telecommunications infrastructure. The introduction of eSIM technology raises concerns over how digital profiles are stored and accessed, especially if they involve cross-border data transfer.

As eSIMs typically require cloud-based infrastructure for remote provisioning, the Chinese government is wary of foreign control over such systems. Any perceived risk that user data could be intercepted or exploited could lead to delays in the technology’s adoption. This concern is particularly heightened when considering China’s focus on maintaining control over data sovereignty.

3. Desire to control telecom markets

In China, mobile service providers have strong governmental backing, and the state prefers to maintain strict control over the telecom market. eSIM technology introduces an element of flexibility and carrier switching that could potentially undermine the government’s control over telecom operations. As eSIM technology would make it easier for consumers to switch between service providers, government regulators are cautious about its potential to disrupt their tightly controlled markets.

Additionally, eSIMs would make it simpler for foreign mobile virtual network operators (MVNOs) to operate in China. The government is likely hesitant to grant foreign operators more power within its telecom market, further delaying the widespread adoption of eSIMs.

Technical limitations: infrastructure and compatibility issues

While China faces substantial regulatory barriers, technical limitations also play a role in delaying the adoption of eSIM technology.

1. Legacy telecom infrastructure

China’s telecom infrastructure is built around physical SIM cards, with traditional SIM provisioning systems still in place. The move to a digital infrastructure supporting eSIM would require significant investment in backend systems, mobile network management, and customer service operations. Telecom providers would need to update and modernize a range of systems to fully support eSIM activation, provisioning, and management.

This legacy infrastructure presents a substantial challenge. The shift to digital SIM technology would require a comprehensive overhaul, which is both costly and time-consuming for operators that have long-established systems in place.

2. Device compatibility

While global smartphone brands like Apple, Google, and Samsung have made eSIM technology a standard feature in their devices, Chinese smartphone manufacturers like Huawei, Xiaomi, and Oppo have been slower to adopt eSIM support.

This is partly due to the focus on local markets where eSIM technology has not yet become a mainstream requirement. As a result, many Chinese smartphones still do not support eSIM, limiting the reach and appeal of this technology among local consumers. In addition, device manufacturers may be hesitant to implement eSIM functionality due to the lack of clear consumer demand.

Consumer preferences in China and Hong Kong

1. Lack of consumer awareness

For Chinese consumers, the move to eSIM technology may not seem urgent. Physical SIM cards are simple to use, familiar, and deeply embedded in the consumer experience. With affordable mobile plans and extensive 4G coverage, most users see little benefit in switching to eSIM. The flexibility offered by eSIM—such as the ability to manage multiple carriers and profiles—is not something that resonates strongly with the majority of Chinese mobile users, who are typically loyal to one telecom provider.

This lack of consumer demand makes it difficult for mobile operators to justify investing in eSIM infrastructure or promoting the technology heavily.

2. Consumer preferences in Hong Kong

In Hong Kong, the situation is somewhat different. As a Special Administrative Region of China, Hong Kong operates under its own legal and economic system, which allows for more flexibility in embracing new technologies. However, the Hong Kong market remains fragmented, with a number of mobile operators each providing different levels of support for eSIM technology. This inconsistency creates confusion for consumers who are unsure whether eSIM is compatible with their devices or which carriers offer the service.

Additionally, the relatively low cost of mobile plans in Hong Kong means that the flexibility to switch between carriers easily—a key benefit of eSIM—is not as compelling as in other regions.

Challenges for telecom operators in China and Hong Kong

1. Lack of standardization

Both China and Hong Kong suffer from a lack of standardization when it comes to eSIM provisioning. Without a unified framework or clear guidelines, mobile operators have been slow to roll out the technology to their customers. This fragmentation is particularly problematic in Hong Kong, where multiple operators offer conflicting services and eSIM-compatible plans.

2. Business incentives

For telecom operators in both China and Hong Kong, there has been limited business incentive to adopt eSIM technology. As the transition to digital SIM cards involves significant upfront costs and system upgrades, operators are waiting for a clear market signal indicating strong consumer demand before committing to eSIM. Until that demand materializes, operators are unlikely to prioritize this technology.

The future of eSIM in China and Hong Kong

Despite these challenges, eSIM adoption in China and Hong Kong is expected to grow in the coming years. As global trends toward digital transformation and 5G deployment continue to accelerate, telecom operators and regulators may begin to see the benefits of eSIM. The government in China may gradually ease some of the regulatory restrictions as the technology becomes more integrated into the global mobile ecosystem, and Hong Kong may continue to refine its approach to eSIM support to meet the demands of international travelers and consumers.

In the long term, eSIM technology could become more widely available as the advantages—such as enhanced security, improved network management, and increased consumer choice—become more evident.

Conclusion

The slow adoption of eSIM technology in China and Hong Kong is a result of a combination of regulatory restrictions, technical challenges, and consumer preferences. While China faces heavy governmental oversight and concerns over data security, Hong Kong contends with fragmented market practices and inconsistent support among telecom operators. However, with global trends pushing towards digital SIMs and greater consumer flexibility, the future looks promising for eSIM technology in these regions.

As China and Hong Kong continue to modernize their telecom infrastructures and adapt to international trends, the transition to eSIM will likely accelerate, paving the way for greater consumer convenience and carrier competition in the years to come.

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.

Seamless Mobile Data Everywhere