Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

Embarking on an international adventure is exciting! You’ve planned your itinerary, booked your flights, and are dreaming of exploring new cultures and landscapes. But before you set off, there’s one crucial step that can save you from significant financial and emotional distress: securing the best travel insurance for international travel. While it might seem like an added expense, think of it as an essential investment in peace of mind for your overseas trips.

Choosing the right coverage can be daunting with so many options available. This guide is designed to help you navigate the world of international travel insurance, understand what to look for in top travel insurance plans for international trips, and ultimately find the best global travel insurance for your specific needs. We’ll provide tips for international trip insurance comparison and ensure you’re well-prepared for any unexpected bumps in the road.

Why International Travel Insurance is Non-Negotiable

Traveling internationally comes with inherent risks that are often not covered by your domestic health insurance or credit card benefits. International travel insurance provides a safety net for unforeseen events such as:

- Medical Emergencies: Accidents or illnesses abroad can result in exorbitant medical bills. Travel insurance can cover hospitalization, doctor visits, and even emergency medical evacuation.

- Trip Cancellation or Interruption: Unexpected events like illness, natural disasters, or political unrest can force you to cancel or cut short your trip, leading to lost expenses on flights, accommodation, and tours.

- Lost or Delayed Baggage: Airlines can misplace or delay your luggage, leaving you without essential items. Insurance can help cover the cost of replacing necessary belongings.

- Travel Delays: Missed connections or significant delays can lead to unexpected accommodation and meal costs.

- Personal Liability: Provides coverage if you accidentally cause injury to someone or damage their property while traveling.

What to Look for in the Best International Travel Insurance

When comparing top travel insurance plans for international trips, consider these key coverage areas and features:

- Medical Coverage Limits: Ensure the policy offers sufficient coverage for medical expenses, including hospitalization, surgery, and outpatient treatment. High limits are crucial for destinations with expensive healthcare.

- Emergency Medical Evacuation: This is vital. It covers the cost of transporting you to the nearest adequate medical facility or back to your home country if necessary.

- Trip Cancellation and Interruption Coverage: Look for policies that cover a wide range of reasons for cancellation or interruption (illness, death in the family, job loss, etc.). Check the percentage of non-refundable costs covered.

- Baggage Loss, Delay, and Damage: Review the coverage limits for lost, delayed, or damaged luggage and personal belongings.

- Coverage for Pre-existing Conditions: If you have any pre-existing medical conditions, ensure the policy offers coverage for them (often requires a medical screening or waiver).

- Adventure Activities Coverage: If you plan on participating in activities like scuba diving, hiking, or skiing, check if the policy covers injuries sustained during these activities.

- 24/7 Emergency Assistance: Access to a 24/7 hotline for emergency support, medical referrals, and travel assistance is invaluable.

- COVID-19 Coverage: In the current climate, ensure the policy explicitly covers medical expenses and trip disruptions related to COVID-19.

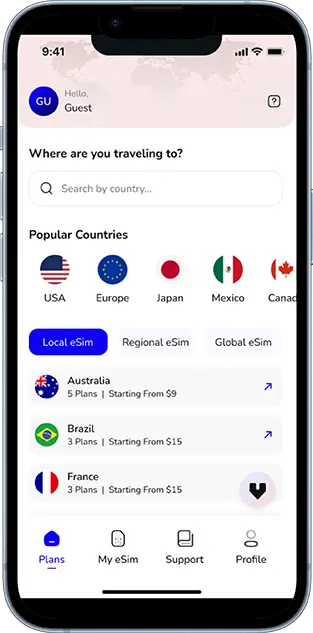

Your Journey, Our eSIM

Stay online abroad with instant activation.

International Trip Insurance Comparison: Finding Your Fit

The “best” policy is subjective and depends on your destination, trip duration, age, health, and planned activities. Performing an international trip insurance comparison is essential.

- Compare Providers: Research reputable travel insurance companies.

- Compare Policy Details: Don’t just look at the price. Carefully compare the coverage limits, deductibles, and exclusions of different policies.

- Read the Fine Print: Pay close attention to the terms and conditions, especially regarding exclusions, pre-existing conditions, and claims procedures.

- Consider Your Destination: Some destinations may require specific types of coverage or have higher risks.

- Assess Your Activities: Ensure your policy covers any adventure sports or high-risk activities you plan to undertake.

Staying Connected and Safe Overseas

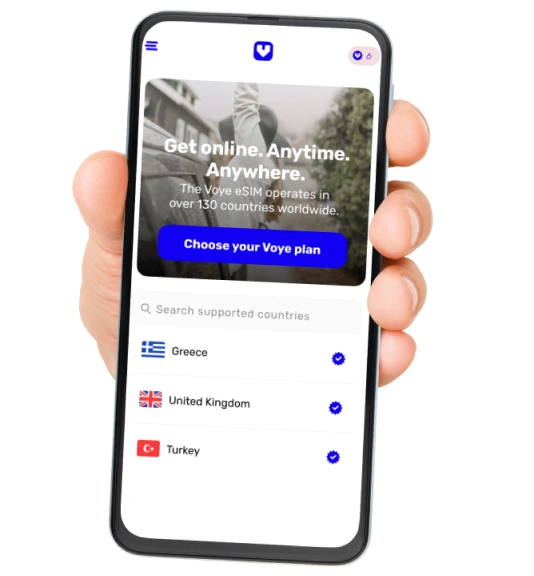

While travel insurance protects you financially, staying connected is crucial for safety and convenience. Having reliable mobile data allows you to access maps, communicate with loved ones, contact emergency services, and manage your travel plans. Avoid expensive international roaming charges by using an eSIM. Voye Global offers affordable eSIM data plans in numerous countries worldwide, ensuring you stay connected seamlessly.

Invest in Peace of Mind

Choosing the best travel insurance for international travel is a critical step in planning any overseas trip. It provides essential financial protection against unexpected medical emergencies, trip disruptions, and other unforeseen events. By understanding what to look for in international travel insurance policies, comparing options carefully, and reading the fine print, you can find the best global travel insurance that meets your needs and allows you to enjoy your adventure with confidence and peace of mind. Don’t leave home without it!

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.

Seamless Mobile Data Everywhere