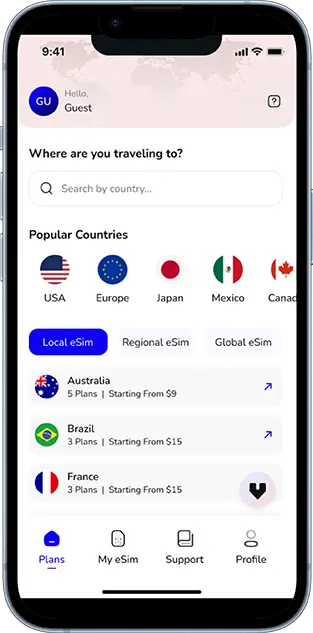

Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

Adventure sports are thrilling — whether you’re paragliding over Swiss Alps, scuba diving in the Maldives, or trekking through the rugged trails of Patagonia. But with great adventure comes greater risk.

That’s why travel insurance for adventure sports isn’t just recommended — it’s crucial.

Many standard travel insurance plans exclude high-risk activities. Without the right coverage, you could face hefty medical bills, trip cancellations, or even evacuation expenses that run into thousands of dollars.

This guide explains everything you need to know about adventure travel insurance, from what it covers to how to choose the right plan for your extreme journeys.

What Is Adventure Sports Travel Insurance?

Adventure sports travel insurance is a specialized policy designed to protect travelers engaging in high-risk activities during their trips.

It typically covers:

- Medical emergencies and evacuations during activities

- Trip interruptions or cancellations due to injury

- Lost or damaged sports equipment

- Accidental death and dismemberment (AD&D) benefits

Adventure travel insurance extends regular coverage to high-risk activities that are usually excluded from traditional policies.

What Activities Are Covered?

Insurance providers define “adventure sports” differently, so it’s essential to read the fine print.

Common activities covered include:

- Scuba diving (with depth limits, e.g., up to 30 meters)

- Paragliding

- Skiing and snowboarding (sometimes on groomed slopes only)

- Mountain biking

- Rock climbing (indoor and limited outdoor)

- Whitewater rafting

- Trekking and hiking up to a certain altitude (e.g., up to 4000 meters)

- Bungee jumping

- Surfing

- Skydiving (some plans)

Some providers offer add-on packs for high-risk adventures like:

- Technical rock climbing

- High-altitude mountaineering

- BASE jumping

- Cave diving

Tip: Always disclose your intended activities before purchasing a policy to ensure you’re fully covered.

What Adventure Travel Insurance Typically Covers

1. Emergency Medical Expenses

If you’re injured during an adventure activity abroad, costs for hospital visits, surgeries, and even air ambulances can skyrocket.

Adventure sports travel insurance covers:

- Doctor and hospital fees

- Surgery costs

- Ambulance services

- Emergency dental care (due to accidents)

2. Emergency Evacuation and Repatriation

Imagine getting injured while trekking in Nepal’s remote mountains.

Evacuations can cost $5,000 to $100,000 depending on location.

Good adventure travel insurance covers:

- Helicopter evacuation

- Medical repatriation to your home country

- Repatriation of remains (in worst-case scenarios)

3. Trip Cancellation or Interruption

If you’re injured before or during your trip and can’t continue, insurance can reimburse:

- Prepaid tours

- Flights

- Accommodation bookings

4. Personal Accident Coverage

Adventure sports insurance typically provides Accidental Death and Dismemberment (AD&D) coverage, offering a payout for:

- Death during activities

- Permanent disability

5. Lost or Damaged Equipment

Expensive gear like GoPro cameras, surfboards, climbing harnesses, or specialized skis can get lost or damaged.

Some insurers cover:

- Rental equipment replacement

- Repair or reimbursement for personal gear

Common Exclusions to Watch Out For

Not all adventure activities are automatically covered. Typical exclusions include:

- Professional sports competitions

- Free solo climbing (climbing without equipment)

- High-altitude climbing (above covered altitudes)

- Deep-sea diving (over 30-40 meters without certification)

- Parachuting/BASE jumping (unless specified)

- Alcohol or drug-related incidents

- Reckless or negligent behavior

Pro Tip: Look for policies that let you add “Adventure Pack” extensions for full coverage.

How to Choose the Best Adventure Sports Travel Insurance

When choosing the right policy, consider these key factors:

1. Understand Your Activities

- Make a list of all the adventure sports you plan to do.

- Check each insurer’s covered activities list.

- Some insurers like World Nomads, IMG Global, and Allianz offer customizable adventure sports coverage.

2. Check Medical Coverage Limits

- Minimum recommended emergency medical coverage: $100,000.

- Evacuation coverage: At least $500,000 if trekking or exploring remote regions.

3. Confirm Gear Protection

- Check if your insurance covers theft, damage, or loss of sports equipment.

- Understand limits — some policies cap equipment coverage around $500-$3000.

4. Review Trip Interruption & Cancellation Terms

- Check if injuries during activities qualify you for full refunds.

- Ensure pre-existing medical conditions won’t void your coverage.

5. Read the Fine Print

- Altitude restrictions (e.g., trekking only below 4000m)

- Water activity restrictions (e.g., certified divers only)

- Certification or training requirements

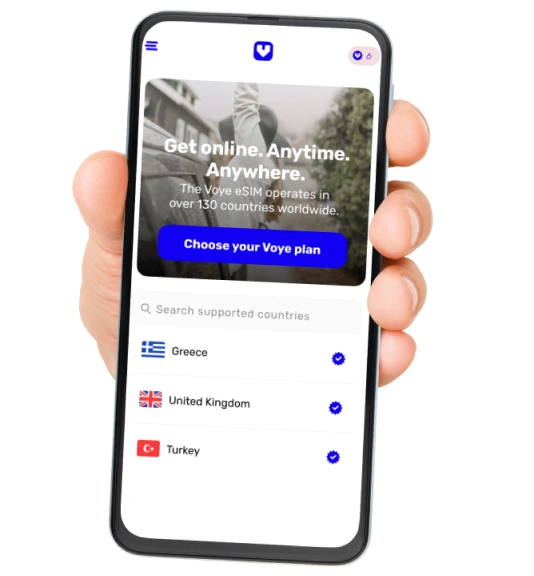

Your Journey, Our eSIM

Stay online abroad with instant activation.

Top Adventure Travel Insurance Providers in 2025

1. World Nomads

- Broad coverage of adventure activities

- Covers over 150 sports and experiences

- Allows extensions while traveling

2. IMG Global (Patriot Adventure Plan)

- Customizable adventure sports add-ons

- Good for Americans and international travelers

- Strong evacuation coverage

3. Allianz Global Assistance

- Strong brand reputation

- Adventure sport optional upgrade available

- 24/7 multilingual customer support

4. SafetyWing

- Excellent for digital nomads who adventure often

- Subscription-based coverage

- Good evacuation and accident benefits

Adventure Travel Insurance Costs: What to Expect

Pricing depends on:

- Traveler’s age

- Length of trip

- Destination (e.g., remote areas cost more)

- Type of activities

On average:

- Basic 2-week adventure insurance: $100 – $300

- High-risk activities like mountaineering or skydiving: $200 – $500+

Adventure Sports That Often Require Special Coverage

Some adventure sports are too risky for regular coverage and require specific rider plans.

Examples include:

| Sport | Requires Rider? | Notes |

|---|---|---|

| Technical Mountaineering | Yes | Especially above 4000m |

| Scuba Diving (Over 30m) | Yes | Dive certification often required |

| Motorbike Touring (Over 125cc) | Yes | Proper license proof needed |

| Whitewater Rafting (Class V) | Yes | Higher river classes mean higher risks |

| Heli-skiing | Yes | Typically excluded unless special policy |

Real-Life Examples: Why Adventure Travel Insurance Matters

Case 1: Broken Leg in the Alps

A traveler snowboarding off-piste in Switzerland broke his leg and needed airlift evacuation.

Cost without insurance? $25,000+.

Insurance payout? Full coverage including hospital stay.

Case 2: Lost Scuba Equipment in Thailand

An adventure diver in Koh Tao lost rental gear due to a strong current.

Rental fees plus lost equipment: $700.

Insurance? Fully reimbursed.

eSIMs and Travel Insurance: A Smart Combo for Adventurers

Staying connected while adventuring is crucial — especially for emergency calls, GPS tracking, or alerting rescue services.

Using an eSIM makes this easy.

Leading providers like Voye Global offer instant connectivity in 170+ countries, perfect for adventure travelers.

- Download an eSIM before you travel.

- Stay connected even in remote areas.

- Contact insurers, emergency services, or family without worrying about roaming charges.

Pro Tip: Always keep your insurer’s emergency number saved offline!

Final Tips Before You Adventure

- Document everything: Receipts, hospital bills, police reports (for claims).

- Carry a copy of your insurance policy and emergency contacts.

- Double-check coverage if your itinerary changes mid-trip.

- Invest in an eSIM to stay reachable anytime, anywhere.

Conclusion: Adventure Smart, Adventure Safe

Adventure sports are exhilarating, but they come with risks that can lead to serious financial and health consequences without the right insurance.

Travel insurance for adventure sports ensures you focus on thrills — not bills.

Before your next skydive, scuba dive, or mountain trek, invest wisely in comprehensive adventure travel insurance and stay connected with a global eSIM.

Because real adventure is about freedom — and nothing feels freer than traveling safely, smartly, and worry-free.

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.

Seamless Mobile Data Everywhere