Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

As the travel industry continues to evolve, insurance providers are seeking innovative ways to adapt to the digital age. Among the most impactful advancements is the integration of eSIM data plans into their offerings.

By leveraging this cutting-edge technology, travel insurance companies are not only enhancing their services but also uncovering lucrative opportunities to boost their revenue.

In this blog post, we’ll delve into the transformative impact of eSIM technology on travel insurance, exploring how it improves customer experiences, streamlines operations, and opens new avenues for growth.

Why eSIM Data Plans Are Revolutionizing Travel Insurance

The global travel industry is witnessing a surge in demand for seamless connectivity and digital solutions.

Travelers now expect convenience and reliability in every aspect of their journey, including insurance.

This shift in expectations has placed eSIM technology at the forefront of innovation for travel insurance providers. Here are the key reasons why eSIM data plans are a game-changer for the industry.

1. Enhanced Connectivity for Travelers

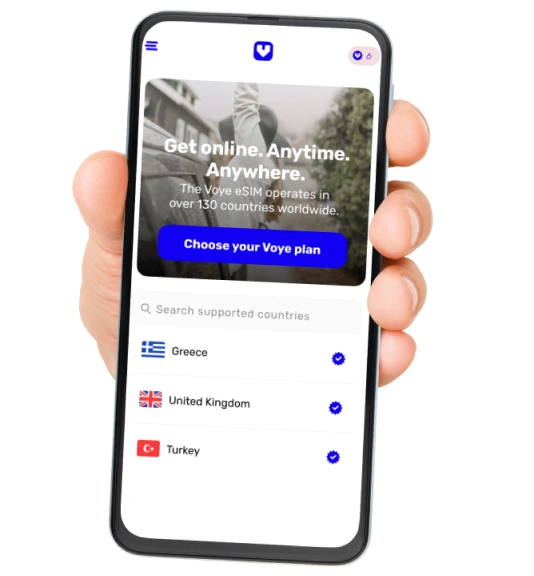

One of the primary reasons eSIM technology is gaining traction in the travel insurance sector is its ability to offer seamless global connectivity.

For travelers, staying connected is essential for navigating foreign destinations, managing itineraries, and accessing emergency services.

By bundling eSIM data plans with insurance policies, providers can:

- Ensure uninterrupted communication for policyholders.

- Offer instant access to travel-related apps, including claims management tools.

- Build trust by providing proactive support during emergencies.

2. Improved Customer Experience

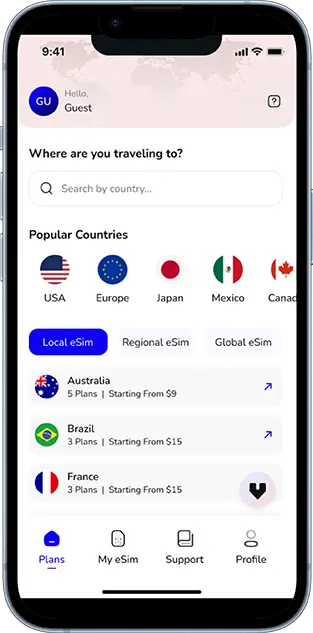

The integration of eSIM technology addresses one of the biggest pain points for travelers: the hassle of staying connected abroad. With no need for physical SIM cards or lengthy activation processes, customers enjoy:

- Quick and hassle-free activation of their eSIM plans.

- The ability to stay connected across multiple countries without additional costs.

- Instant access to their insurance details, coverage, and emergency contacts through mobile apps.

By simplifying connectivity, eSIM technology enhances overall satisfaction and fosters loyalty among travelers.

3. New Revenue Streams

For travel insurance companies, eSIM data plans represent a significant opportunity to diversify and enhance revenue streams. By partnering with eSIM providers or creating their own branded plans, insurers can:

- Offer exclusive connectivity packages as a premium service.

- Introduce tiered insurance plans that include added connectivity benefits.

- Utilize data-driven insights to upsell and cross-sell related services, such as extended coverage or additional travel perks.

How Travel Insurance Companies Are Leveraging eSIM Technology

The integration of eSIM technology is transforming the way travel insurance companies operate and interact with their customers. Below are the practical applications of this technology that are redefining the industry.

1. Bundling eSIM Plans with Policies

Bundling eSIM data plans with travel insurance policies has become a popular strategy among forward-thinking insurers. This approach allows companies to:

- Enhance their value proposition by offering more than just traditional coverage.

- Provide travelers with a seamless way to stay connected and protected.

- Differentiate themselves in a competitive market by delivering a unique, tech-forward experience.

2. Simplifying Claims Processes

One of the biggest challenges for travelers is navigating the claims process, especially in unfamiliar environments. By leveraging eSIM-enabled connectivity, insurers can:

- Facilitate instant claims filing through mobile apps.

- Enable real-time communication between policyholders and claims agents.

- Use geolocation data to verify claims related to flight delays, medical emergencies, or lost luggage.

This streamlined approach not only reduces processing times but also enhances transparency and trust.

3. Proactive Assistance During Emergencies

Emergencies are a key reason travelers invest in insurance, and eSIM technology allows insurers to deliver unparalleled support. With real-time connectivity, companies can:

- Send immediate alerts during natural disasters or travel disruptions.

- Guide travelers to nearby medical facilities, pharmacies, or safe zones.

- Offer 24/7 assistance through messaging apps or dedicated hotlines, ensuring policyholders feel supported at all times.

Stay Connected, Stay Protected

Travel smarter with insurance that includes seamless connectivity.

The Benefits of eSIM Integration for Travel Insurance Providers

Beyond improving the traveler’s experience, eSIM technology offers numerous advantages for insurance providers themselves. These benefits extend to operational efficiency, customer loyalty, and market competitiveness.

1. Increased Customer Retention

Offering value-added services like eSIM plans helps insurers foster stronger relationships with their customers. Travelers are more likely to renew policies with providers who offer comprehensive solutions tailored to their needs.

2. Cost Efficiency

Integrating eSIM technology allows insurers to optimize costs by:

- Automating claims verification using real-time data.

- Reducing fraud through location-based claim validation.

- Streamlining customer support with instant connectivity solutions.

3. Competitive Differentiation

In a crowded insurance market, companies that adopt eSIM integration stand out by:

- Appealing to tech-savvy customers who value innovation.

- Offering unique features that traditional insurers may lack.

- Establishing themselves as leaders in digital transformation.

The Future of eSIM and Travel Insurance

As the travel industry continues to evolve, so too will the role of eSIM technology in shaping the future of insurance. Emerging trends include:

1. Data-Driven Personalization

Access to anonymized eSIM data enables insurers to:

- Develop personalized coverage plans based on travel patterns and behaviors.

- Send proactive reminders about policy renewals or additional coverage needs.

- Tailor marketing campaigns to specific demographics, such as solo travelers or families.

2. Integration with Smart Devices

The future will see eSIM technology integrated with smart devices, such as:

- Wearables that monitor health metrics during travel.

- Smart luggage trackers for added security and convenience.

- Advanced travel apps offer real-time updates on coverage, claims, and emergency assistance.

3. Expansion into Emerging Markets

As global travel increases, insurers can leverage eSIM technology to:

- Enter new markets with growing demand for travel insurance.

- Cater to younger, tech-savvy travelers and digital nomads.

- Offer localized solutions that address specific regional needs.

Boost Your Coverage with Connectivity

Choose a Plan with eSIM Integration and travel with confidence.

Conclusion

The integration of eSIM data plans into travel insurance is a game-changer for both travelers and insurers. For customers, it provides a seamless, reliable way to stay connected while enjoying peace of mind on their journeys.

For providers, it unlocks new revenue streams, enhances operational efficiency, and strengthens customer loyalty.

As the industry embraces digital transformation, the adoption of eSIM technology will continue to grow.

Companies that prioritize innovation and connectivity will not only meet evolving customer expectations but also position themselves as leaders in a highly competitive market.

In a world where connectivity and security are paramount, the future of travel insurance is here — and it’s powered by eSIM technology.

Seamless Mobile Data Everywhere