Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

Traveling abroad is an exciting opportunity to explore new cultures, cuisines, and landscapes. However, it often comes with the risk of overspending, especially when it comes to currency exchange and managing money in foreign destinations. From hidden fees to unfavorable exchange rates, travelers can unknowingly lose significant amounts of money when exchanging currency or using their bank cards. This blog offers practical tips on how to save money, manage your finances smartly, and avoid unnecessary expenses while traveling overseas. We will also touch on how using modern technologies, such as eSIM, can contribute to smarter spending abroad.

1. Plan Ahead for Currency Exchange

One of the biggest mistakes travelers make is waiting until they’ve landed in a foreign country to exchange their money. Airport kiosks and exchange services at tourist locations often have some of the worst exchange rates and high fees. Planning ahead and converting your currency before you leave your home country can help you secure better rates.

Best Time to Exchange Currency

Monitor currency rates a few weeks before your trip. You can use various financial apps to keep track of fluctuations in exchange rates and convert your money when the rate is favorable. Many banks and exchange services offer online options for currency conversion, so you can compare rates and choose the best one.

Avoid Airport Currency Exchange Services

While airport currency exchange counters offer convenience, their rates are often among the worst you’ll encounter. They know that travelers in a rush will prioritize speed over cost, and as a result, they charge hefty fees and offer poor exchange rates.

Consider Prepaid Travel Cards

Another smart option is using prepaid travel cards, which allow you to load currency at a set rate before your trip. These cards help avoid fluctuations in currency rates while offering a convenient and secure way to spend abroad. Prepaid cards usually offer better exchange rates than cash exchanges, and many offer no foreign transaction fees.

2. Use Local Currency for Payments

When you use your debit or credit card abroad, you might be asked if you’d prefer to pay in your home currency or the local currency. While paying in your home currency may seem more straightforward, it often comes with additional costs through dynamic currency conversion (DCC). Merchants and ATMs offering DCC typically mark up the exchange rate, leading to higher fees.

Why Paying in Local Currency is Cheaper

Always choose to pay in the local currency to avoid hidden markups. When your home currency is chosen, the merchant or bank applies their own exchange rate, which is usually higher than the standard bank rate. By opting to pay in local currency, you’ll let your bank handle the exchange, and they often offer better rates.

3. Leverage Fee-Free ATMs and Banking Networks

ATM withdrawal fees can add up quickly when you’re abroad. Each transaction may carry a fixed fee, which can be even higher for international withdrawals. Some banks even charge a percentage of the withdrawal amount as an additional fee. However, there are ways to avoid or minimize these charges.

Look for Global ATM Alliances

Many banks are part of global ATM networks, where they have agreements with other international banks to offer fee-free or reduced-cost ATM withdrawals. Research whether your bank is part of a global alliance and locate affiliated ATMs in your destination country before you travel.

Opt for Banks with Low Foreign Transaction Fees

Another option is to open an account with a bank that offers low or no foreign transaction fees on ATM withdrawals. Several online and international banks cater specifically to frequent travelers, offering fee-free transactions and competitive exchange rates.

4. Use Credit Cards with No Foreign Transaction Fees

If you’re a frequent traveler, it’s worth investing in a credit card that offers no foreign transaction fees. Most credit cards charge between 1% and 3% per transaction when used abroad, which can quickly add up if you’re making multiple purchases each day.

Best Features of a Travel Credit Card

Look for a credit card that offers:

- No foreign transaction fees

- A competitive rewards program (for travel points or cash back)

- Worldwide acceptance (such as Mastercard or Visa)

- Strong fraud protection measures

Many travel-focused credit cards also offer additional perks like travel insurance, purchase protection, and access to airport lounges. Some cards even offer bonus points on foreign purchases, making them even more beneficial when spending abroad.

5. Avoid Foreign Currency Conversion Fees

When shopping abroad, always be cautious of merchants or service providers who offer to convert your payment into your home currency. As mentioned earlier, this practice, known as dynamic currency conversion (DCC), often results in less favorable exchange rates and additional fees.

How to Avoid DCC

To prevent DCC fees, double-check with the merchant that you are being charged in the local currency before completing your transaction. If you’re withdrawing cash from an ATM, make sure you decline any offers to convert the amount into your home currency.

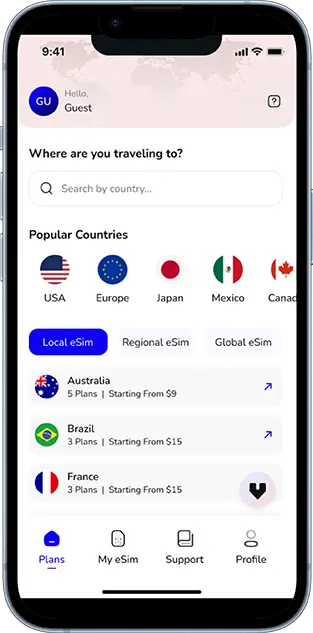

6. Stay Connected with an eSIM

When traveling abroad, data roaming charges can be exorbitant. Using your regular SIM card to access mobile data in another country can lead to unexpected bills. A smart way to cut down on overseas spending is by using an eSIM.

An eSIM allows you to connect to local networks without physically changing SIM cards. It’s especially useful for travelers because:

- You can purchase data plans for your destination country before or during your trip.

- It eliminates roaming fees by using local rates.

- You can switch between networks seamlessly without having to visit a store or buy a physical SIM card.

- Many eSIM providers offer pay-as-you-go or short-term plans designed specifically for travelers.

This technology helps you stay connected while keeping communication costs low. Additionally, if you’re traveling across multiple countries, you can switch plans or add new ones as you go without needing to buy local SIM cards in each location.

Stay Connected Without the Extra Costs

Travel smarter with an eSIM – instant setup, local rates, no surprises.

7. Consider Using Mobile Payment Apps

Mobile payment apps like PayPal, Venmo, and Revolut are widely accepted in many parts of the world and can be a great alternative to carrying cash. These apps allow you to make purchases, split bills with fellow travelers, and even send money back home—all with minimal fees.

Benefits of Mobile Payment Apps

- Convenience: You can make purchases directly from your phone, reducing the need for cash or cards.

- Security: Mobile payment apps are often more secure than carrying physical cash or cards.

- Low Fees: Many apps offer favorable exchange rates and low international transaction fees.

Before traveling, check which mobile payment services are popular and widely accepted in your destination.

8. Monitor Your Spending with Budgeting Apps

When traveling, it’s easy to lose track of how much money you’re spending. To avoid this, use a budgeting app that tracks your transactions in real-time. Apps like Mint, YNAB (You Need A Budget), and PocketGuard can help you set a daily or trip-wide budget and notify you when you’re approaching your limit.

Features to Look for in a Budgeting App

- Currency Conversion: An app that automatically converts your expenses into your home currency can help you understand how much you’re really spending.

- Expense Categorization: This feature lets you track how much you’re spending on food, transportation, souvenirs, and more.

- Notifications: Look for apps that send push notifications to alert you when you’re approaching your budget limit.

These apps not only help you stay on track but also offer insights into your spending habits, allowing you to adjust as needed during your trip.

9. Avoid Hidden Hotel and Travel Fees

Many hotels and airlines have hidden fees that can inflate the total cost of your trip. Being aware of these fees in advance can help you avoid unnecessary charges.

Common Hidden Fees to Watch For

- Resort Fees: Many hotels charge daily resort fees that cover amenities like Wi-Fi, pool access, and gym use. Always check if these fees are included in your room rate.

- Early Check-In or Late Check-Out Fees: If your travel schedule requires flexibility, confirm the costs of early check-ins or late check-outs to avoid surprise charges.

- Baggage Fees: Some airlines charge for checked baggage or even carry-on luggage. Make sure you’re aware of your airline’s baggage policies before booking.

By being proactive and asking about these fees before booking, you can save money and prevent unexpected charges.

10. Utilize Duty-Free Shopping Wisely

Duty-free shops, often found in airports, offer products free from certain taxes and duties. While these shops can offer discounts on luxury goods, alcohol, and tobacco, they don’t always guarantee savings.

How to Maximize Duty-Free Savings

- Research Prices Before You Go: Knowing the regular retail price of an item in your home country can help you determine if you’re actually getting a deal.

- Stick to High-Tax Items: Items like alcohol and tobacco usually offer the best savings in duty-free shops since they’re subject to higher taxes in most countries.

- Be Aware of Quotas: Many countries have limits on how much you can bring back duty-free, so make sure you know the rules before making large purchases.

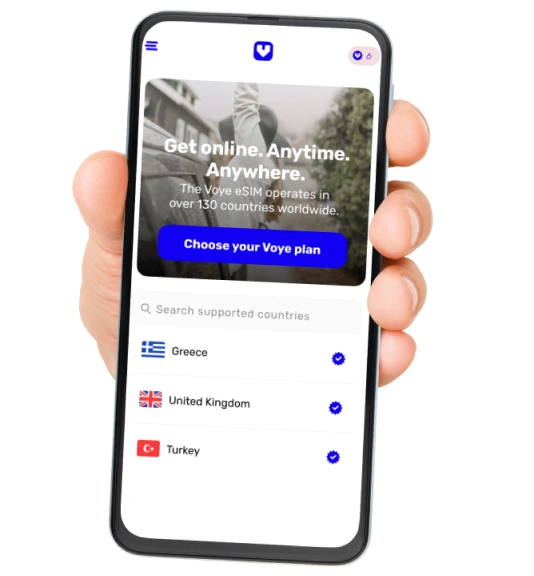

Save on Roaming, Spend on Adventures

eSIM offers local rates in 130+ countries. Stay connected and save.

Final Thoughts

Traveling doesn’t have to come with financial stress if you plan ahead and make smart money decisions. By utilizing the right tools—such as fee-free banking, travel credit cards, budgeting apps, and eSIM technology—you can reduce unnecessary spending and make your trip more enjoyable. Always be aware of the local currency options and hidden fees that can eat into your budget, and take advantage of modern solutions to stay connected without breaking the bank.

Embrace these smart money exchange tips, and you’ll be able to focus on creating memories rather than worrying about finances.

Seamless Mobile Data Everywhere