Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

What Is the Market Trend for eSIM? A Complete Analysis

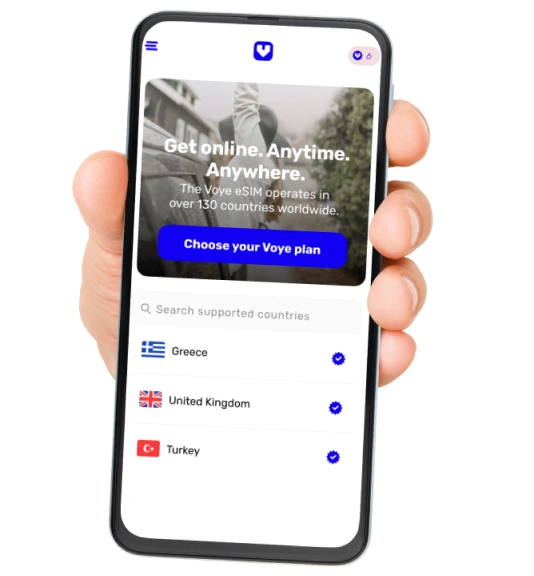

eSIM technology is transforming how the world connects. Once reserved for premium flagship devices, eSIM has rapidly infiltrated billions of smartphones, wearables, IoT deployments, connected vehicles, and enterprise systems. As global travel digitizes and industries shift away from physical infrastructure, eSIM is not just a convenience upgrade. It is becoming a core engine of the mobile connectivity ecosystem.

If you’re looking to understand the current market trend for eSIM, here’s the short answer:

The eSIM market is in a phase of explosive growth, driven by mass smartphone adoption, an expanding travel market, accelerating IoT deployments, and strong momentum in automotive and enterprise mobility.

Understanding eSIM and Its Market Impact

An eSIM (embedded SIM) is a built-in, programmable SIM that is integrated directly into a device’s hardware. Unlike traditional physical SIM cards, eSIMs enable remote provisioning—allowing users to activate a mobile plan or switch operators without inserting or replacing a card.

This seemingly small change has massive implications:

- Devices become slimmer, more secure, and more durable.

- Mobile carriers must redesign their onboarding and activation systems.

- Global travelers can switch plans instantly with QR-based activation.

- Enterprise and IoT deployments become more scalable and manageable.

- Manufacturers gain design flexibility and higher product reliability.

The shift from physical SIMs to eSIM is as significant as the transition from wired internet to Wi-Fi. It reshapes the connectivity landscape entirely.

Global Market Growth and Expansion

While different research companies quote slightly different numbers, they all agree on one universal trend: the global eSIM market is expanding rapidly and will continue to grow through the next decade.

The market today is already valued in the multi-billion-dollar range, with projections indicating steady, strong growth up to 2030 and beyond. As more devices adopt eSIM by default, especially smartphones, the base of active eSIM users expands at scale.

Several factors fuel this growth:

- Massive consumer demand for flexibility and instant connectivity

- Device makers eliminating physical SIM trays from high-end models

- Carriers enabling eSIM onboarding to stay competitive

- IoT manufacturers choosing eSIM for long-term deployments

- Enterprise mobility platforms shifting towards digital-first solutions

In other words: the eSIM market is not growing linearly. It’s accelerating.

The Role of Smartphones in eSIM Adoption

The smartphone sector is the largest contributor to eSIM adoption worldwide. What started with a small number of premium devices has become a mainstream standard.

Device makers are driving this shift:

- Some global smartphone models now ship without physical SIM slots in certain regions.

- Android manufacturers are steadily rolling out eSIM support across mid-range and flagship devices.

- Users have become increasingly aware of eSIM’s convenience—especially during international travel.

Smartphones account for the majority of eSIM activity today, and this share will continue rising as more models default to eSIM-only designs. This also accelerates operator readiness, consumer onboarding, and awareness.

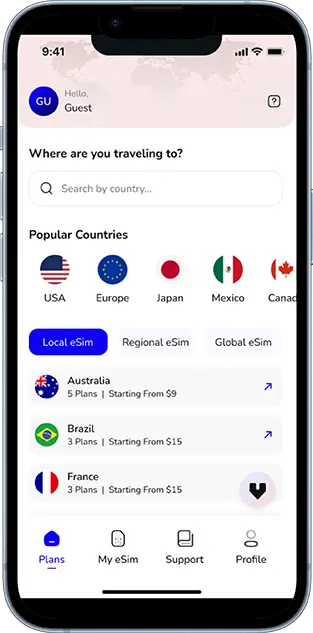

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.

Travel eSIM: The Fastest-Growing Segment

One of the hottest segments in the eSIM industry is travel eSIM, which allows users to get instant connectivity when visiting another country without buying a physical SIM card.

Several factors make travel eSIM a major driver of market growth:

- The rise of digital nomads and remote workers

- Surge in international travel post-pandemic

- Increased smartphone adoption with dual eSIM capability

- Easier and cheaper alternatives to expensive international roaming

- Instant activation through apps or QR codes

For millions of travelers, their first experience with eSIM comes from buying a travel data plan. Once they use it, the convenience often encourages them to continue using eSIM for future trips.

This trend not only disrupts traditional roaming revenue but also pushes mobile operators to offer more competitive global travel packages.

IoT, Industrial Use, and Machine-to-Machine Connectivity

Beyond consumer devices, eSIM is rapidly reshaping the IoT and industrial connectivity landscape. The growth in IoT deployments across sectors such as utilities, logistics, industrial automation, and healthcare has increased demand for secure, remotely manageable connectivity.

Industries favor eSIM for several reasons:

- Devices can be deployed globally without worrying about local SIM cards.

- SIM provisioning, switching, and updates can be performed over the air.

- Hardware access becomes unnecessary, which is crucial for remote or sealed devices.

- Enterprises can choose global or regional operators without being locked into one provider.

In industrial environments where maintenance windows are limited, eSIM enables unprecedented efficiency and flexibility.

Automotive eSIM: A Major Growth Engine

The automotive industry is another strong contributor to the eSIM boom. Connected vehicles rely on always-on mobile data for:

- Navigation and mapping

- Telematics and diagnostics

- In-car entertainment

- Emergency communication systems

- Autonomous and assisted driving technologies

- Fleet tracking and remote updates

As new vehicles become more software-driven, eSIM ensures that connectivity is built-in, secure, and update-ready. This is critical for modern features such as OTA updates, AI-powered mobility platforms, and integrated services.

The future of connected vehicles heavily relies on embedded connectivity—making eSIM indispensable.

Enterprise Mobility and Corporate Connectivity

Enterprises are increasingly adopting eSIM for employee devices, corporate travel, and global fleet management. The shift to hybrid work environments and the need for international mobility has accelerated this trend.

Benefits for enterprises include:

- Seamless provisioning of employee devices

- Remote SIM assignment for traveling staff

- Better control over corporate data plans

- Ability to manage thousands of devices from a central dashboard

- Elimination of bulky SIM card distribution

- Easier deployment across multiple countries

For companies with international operations, eSIM significantly reduces complexity and cost.

Regional Market Trends and Adoption Patterns

Different regions are adopting eSIM at different speeds, creating a dynamic global map of growth opportunities.

North America

- High adoption among smartphone users

- Strong push from leading tech companies

- Major carriers have fully integrated eSIM support

- Travel eSIM usage growing rapidly

Europe

- Early adopter of connected car regulations

- Strong regulatory support for digital onboarding

- High number of operators competing with digital-first brands

- Robust traveler demand

Asia-Pacific

- Fastest-growing eSIM region globally

- Rapid smartphone penetration and IoT expansion

- Growth driven by device manufacturers and competitive carriers

Emerging Regions

- eSIM becoming a solution for areas with limited retail SIM distribution

- Adoption rising through mid-range devices and travel eSIM apps

This regional diversification ensures that the eSIM market maintains long-term, geographically balanced growth.

Consumer Behavior and Awareness Trends

Consumer demand plays a major role in eSIM’s rapid rise. Over the past few years, the following behavioral shifts have become clear:

Growing Awareness

Users are increasingly aware that their smartphones support eSIM and are more comfortable activating plans digitally.

Preference for Instant Connectivity

With more digital onboarding flows, users now expect SIM activation to be instant and app-based.

Dual Usage and Multi-Profile Behavior

A growing number of people use multiple eSIM profiles:

- One for home

- One for travel

- One for work

This flexibility drives higher usage rates and encourages people to move away from physical SIM cards permanently.

Your Journey, Our eSIM

Stay online abroad with instant activation.

Challenges Slowing Down eSIM Adoption

Despite its momentum, the eSIM market faces a few challenges that affect adoption speed in certain regions.

Carrier Reluctance

Some carriers are slow to embrace eSIM due to concerns about:

- Customer churn

- Reduced control over user acquisition

- Potential revenue loss from international roaming

Fragmented User Experience

Different devices and networks have varying activation flows, causing confusion for first-time users.

Regulatory Hurdles

Certain countries have strict identity verification rules that complicate instant eSIM activation.

IoT Standardization

IoT requires unified standards for mass adoption, and industry alignment is still evolving.

While these challenges exist, none are strong enough to slow down overall global momentum.

Future Market Trends for eSIM

Looking ahead, the eSIM market is set for even deeper transformation. Several future trends will shape what comes next.

Rise of eSIM-Only Smartphones

More manufacturers are moving toward eliminating physical SIM trays entirely. This further accelerates adoption.

Growth of iSIM (Integrated SIM)

iSIM integrates connectivity directly into the device chipset, reducing cost and expanding use cases across IoT.

Consolidation of Travel eSIM Providers

As competition intensifies, the market will consolidate around brands that offer:

- Better coverage

- Stronger apps

- More seamless activation

- Competitive pricing

Industry-Specific eSIM Solutions

We will see more tailored eSIM offerings for:

- Automotive

- Healthcare

- Logistics

- Enterprise fleets

- Smart energy systems

Stronger Integration with 5G and Private Networks

Enterprise-grade 5G private networks rely on secure onboarding—eSIM plays a vital role here.

Sustainability Benefits

As industries reduce reliance on plastic SIM cards, eSIM aligns perfectly with sustainability and digital transformation goals.

What the Market Trends Mean for Different Stakeholders

For Mobile Operators

eSIM reduces logistics and offers new revenue opportunities through digital-first offerings. Operators must compete through:

- Better onboarding

- Creative plans

- Stronger traveler packages

- Digital apps and self-service tools

For Device Manufacturers

eSIM unlocks new design freedom and improved durability. Companies that adopt eSIM-only models early will shape the future device ecosystem.

For Enterprises

Global companies benefit from simplified device management, reduced costs, and secure remote provisioning.

For Consumers

The biggest advantage is convenience. eSIM empowers users to activate, switch, and manage plans instantly.

Conclusion: The eSIM Market Trend Is Clear

The eSIM market is on an unstoppable growth trajectory. From smartphones and travel to IoT, vehicles, and enterprises, eSIM has become the new backbone of global connectivity.

Key takeaways:

- The global eSIM market is expanding at a powerful pace.

- Smartphones, travel eSIM, IoT, automotive, and enterprise mobility continue driving adoption.

- Regional adoption is strong across North America, Europe, and Asia-Pacific, with emerging markets catching up quickly.

- Despite a few challenges, eSIM’s long-term future is secure and full of potential.

- The next generation of devices will increasingly adopt eSIM-only or iSIM technologies.

In a world moving rapidly toward digital, borderless, software-defined communication, eSIM stands at the center of the transformation.

Seamless Mobile Data Everywhere