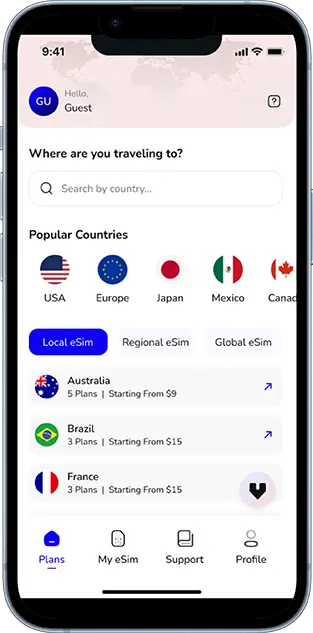

Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

A Gentle Start as the Year Winds Down

There is a special calm that appears toward the end of every year. Plans slow down, people begin preparing for gatherings, and the air feels a little more relaxed. Cafes stay full with friends catching up. Families begin discussing winter trips. Young professionals think about what the next year might hold and what changes they want to bring into their routines.

This part of the year naturally encourages reflection. It encourages you to sit back, think about everything you did, everything you learned, and everything you want to change. It becomes easier to imagine a smoother, more organised version of the future. This is exactly why year-end is such a powerful moment for financial planning. You get the clarity, quiet, and emotional readiness to build a better structure for the year to come.

Preparing for a Strong 2026: Your Financial Rese

Preparing for a strong 2026 begins with understanding where your money went in 2025 and what habits shaped your year. A clear look at your spending patterns helps you decide what to keep, what to adjust, and what deserves a complete reset.

Looking Back at 2025 Spending

Start with a simple review. Think about where your money genuinely went in 2025. Check your spending patterns, your food orders, your subscriptions, your emergency purchases, your impulse buys, your savings efforts, and your large, unavoidable expenses. Every category teaches something. Some expenses highlight carelessness, while some reveal how much value they added to your life.

These insights become powerful tools as you begin shaping 2026. You understand what to repeat, what to adjust, and what to completely avoid.

Setting Goals That Make Sense for Your Life

Goals are the heart of financial planning. Think about what you want to experience in 2026. Maybe it is a dream trip. Maybe it is a professional course. Maybe it is a device upgrade that makes your work more efficient. Maybe it is a strong savings plan or a healthier investment habit.

When your goals connect to your real life, sticking to them becomes much easier.

Stay Connected Anywhere

Get fast and reliable travel data ready before your trip begins.

Creating a Practical 2026 Budget

A useful budget has space for everything. Essentials, lifestyle categories, entertainment, personal growth, emergencies, and travel. It should not feel suffocating. It should feel realistic. A rolling twelve-month plan is often the easiest way to stay balanced because you can see the year as a full picture rather than as chaotic monthly surprises.

Give your budget a personality that suits your lifestyle instead of trying to copy someone else’s system.

Smart Money Moves for 2026

Smart money moves for 2026 begin with refining how you save, invest, and manage recurring expenses. Small adjustments like increasing SIPs, trimming wasteful spending, and planning tax decisions early can create a noticeably stronger financial foundation.

Early Tax Planning

Tax planning should begin early instead of during the last-minute rush. Decide which regime suits you. Check which deductions genuinely help you. Use health insurance benefits, retirement plans, and any employer benefits that reduce your tax load. When tax planning becomes part of your year-long strategy, it feels peaceful rather than stressful.

Strengthening Your Investment Structure

Consider reviewing your investments before the year ends. Increase SIPs if possible. Rebalance your equity and debt ratio. Allocate a portion of your savings to a short-term emergency fund. Align your investments with your 2026 goals, so they support your plans rather than conflict with them.

Managing and Reducing Debt

Debt management is a critical part of preparing for 2026. Whether it is credit card bills, personal loans, or BNPL dues, a proper repayment strategy helps you start the new year with a lighter mind. Snowball or avalanche, choose whichever method feels natural to maintain.

Planning Key 2026 Expenses Smoothly

A little foresight goes a long way. When you list out your big 2026 expenses and start preparing for them now, you protect your budget and make the entire year far more manageable.

Major Purchases and Annual Costs

Create sinking funds for predictable expenses. This includes insurance renewals, school fees, medical checkups, domestic travel, home maintenance, and new gadgets. When these are pre-planned, they never destabilise your financial rhythm.

Travel Budgeting for the New Year

Travel is now a major part of modern lifestyles. Whether it is a beach escape, a mountain trip, or an international holiday, planning saves money and reduces last-minute tension. Early bookings also let you explore more options.

Travel also becomes easier when small conveniences are in place. Smooth navigation, simple access to maps, quick coordination with friends, and effortless management of bookings enhance the entire trip. This is often where people feel the difference between stressful travel and peaceful travel.

Instant Travel Connectivity

Activate your eSIM in minutes and avoid airport SIM hassles.

Festive and Holiday Spending

Festive spending should be planned rather than spontaneous. Set a comfortable budget for gifting, celebrations, weddings, and social commitments. You can enjoy every moment without carrying financial regret into January.

Smart Tech Choices That Support a Better 2026

Smart tech choices can make daily routines smoother and more efficient in 2026. Choosing devices and tools that support productivity, easy organisation, and stress-free travel helps you stay financially and mentally balanced throughout the year.

Planning Device Upgrades for the New Year

Tech upgrades should be planned like any other financial decision. Phones, laptops, and accessories are long-term tools. Choose devices that support your lifestyle and make your daily routine smoother. While planning upgrades, think about long-term cost efficiency, app performance, reliability, and how easily the device integrates with your overall digital habits.

During travel, this becomes even more noticeable. The ability to find routes quickly, handle bookings without friction, avoid typical tourist confusion, or stay in touch with family easily can greatly improve the experience.

Tiny Tools, Big Travel Wins

Every year, travel becomes more dependent on smooth planning. People prefer tools that remove delays and reduce the effort required to stay organised. Whether it is finding directions, checking prices, confirming reservations, or coordinating with others, small digital conveniences improve every part of a journey.

This is where eSIM enters the conversation naturally. It is one of the simplest tools that improves travel comfort, financial control, and accessibility at the same time.

Here is how eSIM fits into year-end financial planning.

Saving Money Before 2026 Hits Different

Saving money before 2026 feels different when you focus on trimming recurring expenses and choosing smarter alternatives. Small, consistent optimisations across monthly bills and lifestyle habits can create a surprisingly big impact.

Year-End Cost Optimization

This is one of the strongest areas where eSIM plays a major role. Telecom bills are a recurring monthly expense, so optimizing them impacts your budget directly.

Compare Plans Across Carriers

eSIM makes switching carriers faster and easier. You can explore which company gives the best data, call rates, or value packs without handling physical SIM cards. This encourages healthier financial decisions since you are not locked into one provider.

Smarter Way to Roam

Skip roaming fees and switch to a convenient digital eSIM.

Track Data Usage for Digital Habits

UPI payments, streaming apps, work calls, and social media require constant data. With eSIM, comparing plans or switching to cheaper data packs becomes simple.

Dual eSIM Setup

You can maintain separate work and personal numbers without buying an additional phone. This can reduce device-related costs while keeping life organised.

This fits perfectly under cost-saving sections like Cutting Recurring Expenses Before 2026.

Travel Without Breaking the Wallet

You do not need an oversized budget to enjoy great trips. With a little planning and a few cost-saving tweaks, you can explore new places, avoid expensive surprises, and make every journey feel lighter on the wallet.

Travel Budgeting for the Holidays

Holiday spending can become unpredictable. International roaming charges can sometimes be shockingly high. eSIM helps you completely avoid this.

International eSIM Packs

Instead of buying expensive roaming plans, travellers can use international eSIM packs that cost significantly less.

Prepaid Country eSIMs

You can buy an eSIM for the country you are visiting before the trip begins. These prepaid eSIMs often cost far less than telecom IR packs.

Save Money on Every Trip

Depending on the destination, travellers can save between one thousand and five thousand rupees every trip.

This fits beautifully into a section like How to Survive Holiday Spending Without Overshooting Your Budget.

Travel Without Limits

Enjoy secure and high-speed data supported across global networks.

Upgrade Smart, Save Smart

Upgrading smartly means choosing devices and tools that offer long-term value rather than short-term excitement. When your upgrades support efficiency, reliability, and cost control, you save more while getting better performance throughout 2026.

Device Upgrade Planning for 2026

Many popular devices now support eSIM. Budgeting for an upgrade while considering eSIM support helps you plan better.

Long Term Savings

eSIM-only phones allow easy switching, which improves long-term cost control.

Better Digital Lifestyle

A digital-first lifestyle supports financial organisation and overall convenience.

This fits into a section like Smart Tech Decisions That Improve Your Finances in 2026.

Stay Prepared, Stay Secure

Staying prepared and secure in 2026 means having easy access to your essential accounts and information. When your tools allow quick recovery and minimal downtime, handling financial and digital emergencies becomes much easier.

Travelers can benefit from the travel toolkit 2026, which highlights essential tools and strategies for smooth trips. Maintaining reliable connectivity is also crucial, and Connectivity Hacks 2026 provides tips for staying online while moving between destinations.

For seamless mobile access everywhere you go, selecting the best eSIM for 2026 ensures you stay connected without the hassle of local SIMs or interruptions, whether booking experiences, navigating cities, or staying in touch with family and colleagues.

Safety and Continuity During Emergencies

Financial security involves protecting access to your banking and identification tools.

Faster Number Replacement

If your phone is damaged or stolen, replacing your number on an eSIM is faster compared to traditional SIM cards.

Protect Banking Access

Since UPI apps and banking OTPs depend on your number, quick recovery reduces downtime and financial risk.

This fits naturally in Strengthening Your Digital Financial Security for 2026

Work Anywhere, Save Everywhere

Working from different locations becomes much easier when your setup is flexible and cost-efficient. Choosing affordable data options and tools that travel well helps you stay productive without increasing monthly expenses.

For Remote Workers and Freelancers

People who work across locations or switch networks regularly benefit hugely from eSIM.

Instant Plan Switching

If one operator is expensive or slow, switching is simple.

Travel Friendly

Travel eSIMs support location-independent work and help avoid network-related delays.

Eco-Friendly Habits Are the Future

Sustainable habits are becoming a natural part of modern lifestyles. When you choose options that reduce clutter and cut down on unnecessary plastic, you make everyday living easier while supporting long-term environmental health.

Sustainability Benefits

eSIM is also becoming part of sustainable digital habits.

Less Plastic Waste

Traditional SIM cards require plastic trays and packaging. eSIM avoids all that.

Digital Management

Everything is managed online, making it easy to organise plans and reduce clutter.

This works well in a smart habits or sustainability section.

Travel, but Make it Delightfully Simple

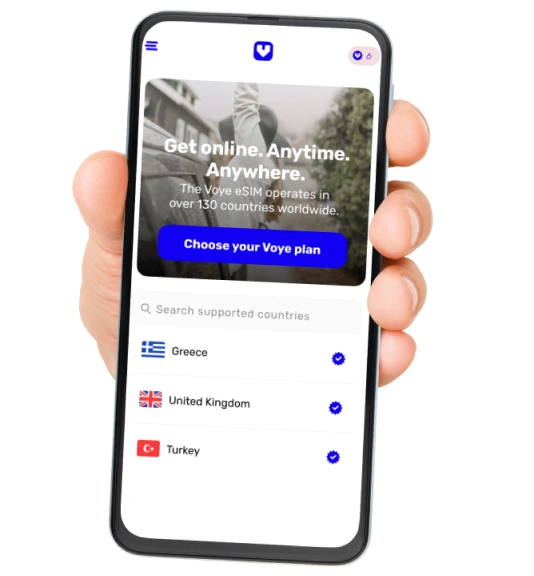

This is where Voye Global steps in. Voye Global provides reliable eSIM services across more than one hundred and seventy destinations. It makes travel simpler, smoother, and far more predictable.

With Voye Global, you do not need to wait in long queues at airports. You do not need to search for local SIM stalls. You do not need to juggle multiple cards or worry about roaming bills. You activate your plan digitally and begin your journey with confidence.

Navigating new places becomes easier. Communicating with loved ones becomes effortless. Checking travel updates or handling bookings feels natural instead of stressful. Voye Global supports your trip quietly in the background while you enjoy the experience itself.

Here Is Your 2026 Glow Up Moment

As the year comes to an end, your financial planning, travel dreams, and lifestyle upgrades deserve a fresh start. With thoughtful budgeting, smarter tech decisions, and modern tools like eSIMs, your 2026 can begin with clarity and confidence. May your new year be smoother, more organised, and filled with journeys that make you smile.

Seamless Mobile Data Everywhere