Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

Picture this: You’re exploring the cobbled streets of Rome, hiking the Inca Trail, or diving off the coast of Thailand — when an unexpected accident, illness, or emergency strikes.

Without proper international travel insurance, your dream trip could quickly turn into a financial nightmare.

But here’s the real question:

Is health insurance actually required for international travel?

The short answer: In some cases, yes. In many cases, it’s strongly recommended even if it’s not legally required. Some countries and visa applications mandate proof of travel health insurance, while others simply advise it for your protection.

In this comprehensive guide, we’ll walk you through:

- When and where international travel health insurance is required

- Why you should never travel abroad without it

- Countries that mandate travel medical insurance

- What coverage you really need

- How to choose the best travel health insurance for your trip

- Common mistakes to avoid

Let’s dive deep so you can travel smarter — and safer.

Is Health Insurance Mandatory for International Travel?

In some countries, yes.

For most travelers, it’s highly recommended.

Here’s a quick overview:

| Scenario | Is Travel Health Insurance Required? |

|---|---|

| Traveling to Schengen Zone (Europe) | Yes, for visa applicants |

| Applying for visas to countries like UAE, Turkey, Cuba | Yes |

| Traveling to countries without mandatory insurance laws (e.g., USA, Japan) | No, but highly recommended |

| Using private tour packages, cruises, or student exchange programs | Often yes, required by organizers |

1. Schengen Visa Countries

If you are applying for a Schengen Visa (covering 27 European countries), you must provide proof of travel medical insurance.

Requirements include:

- Minimum coverage of €30,000 (~USD 33,000)

- Coverage for medical emergencies, repatriation

- Valid throughout your entire stay across the Schengen Area

Countries include: France, Germany, Italy, Spain, Netherlands, and more.

2. Destinations with Mandatory Travel Health Insurance

Some countries require visitors to have health insurance to enter, even if you’re not applying for a visa. Examples include:

- Cuba: Must show proof at arrival

- Turkey: Required for visa applicants

- United Arab Emirates (Dubai, Abu Dhabi): Required for visa

- Russia: Required for visa

- Qatar: Health insurance is required for some travelers

- Ecuador (including Galápagos Islands): Mandatory travel insurance required

3. High Medical Cost Countries (Highly Advised Even if Not Mandatory)

In countries like the United States, Canada, Japan, and Australia, medical costs are extraordinarily high.

While not mandatory for entry, travel medical insurance is strongly recommended to avoid massive out-of-pocket expenses.

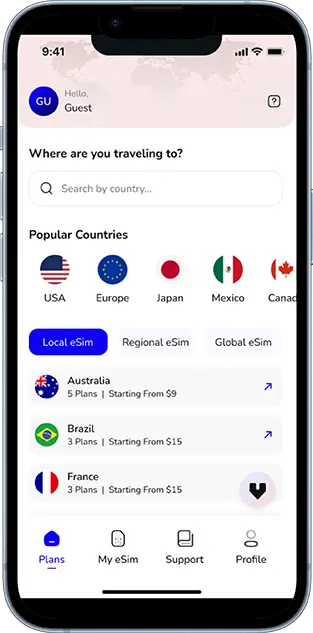

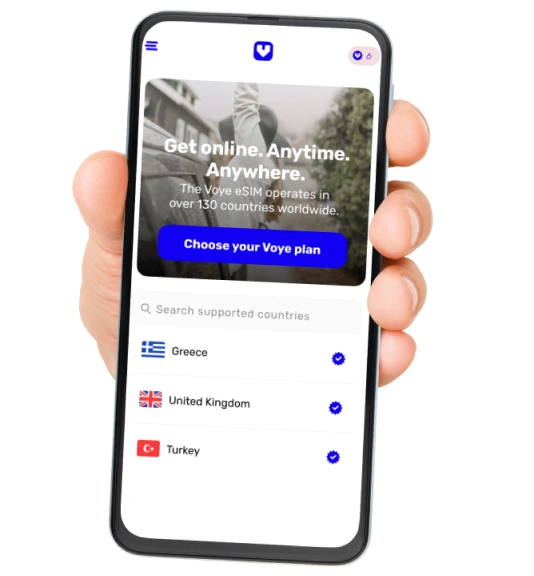

Your Journey, Our eSIM

Stay online abroad with instant activation.

Why You Should Never Travel Without Health Insurance

Even if a country doesn’t require it, skipping travel insurance is risky.

Here’s why:

1. Healthcare Abroad Is Expensive

A single emergency room visit in the U.S. can cost over $2,000. A broken bone could cost you $10,000+ without insurance.

2. Your Domestic Health Plan May Not Cover You

Most local health insurance policies (like those from India, the U.K., Australia, etc.) do not offer full international coverage.

3. Medical Evacuation Costs Are Sky-High

If you need air ambulance evacuation (e.g., from a remote island or mountain), it could cost $20,000 to $250,000!

4. Protection Against Trip Cancellations and Interruptions

Good travel insurance also covers:

- Trip delays

- Cancellations

- Lost luggage

- Emergency evacuations (medical and political)

Countries That Require Travel Health Insurance for Entry

Here’s a current list of countries (2025) that require visitors to have valid international health insurance or proof of coverage:

| Country | Insurance Requirement Details |

|---|---|

| Schengen Countries | Required for visa applicants |

| Cuba | Must show proof at immigration |

| Russia | Required for visa |

| UAE | Required for visa applicants |

| Turkey | Required for visa |

| Ecuador (Galápagos) | Mandatory |

| Qatar | Required for certain visa types |

| Thailand | May require insurance depending on visa |

Always verify requirements close to your travel date, as policies can change.

What Should Travel Health Insurance Cover?

When choosing an insurance plan for international travel, make sure it covers the essentials:

1. Emergency Medical Expenses

Covers hospitalization, doctor’s visits, surgeries, and medications.

2. Emergency Medical Evacuation

Pays for air evacuation to the nearest adequate facility.

3. Repatriation of Remains

In case of death, covers transport of remains to your home country.

4. Trip Cancellation or Interruption

Reimburses prepaid expenses if your trip is canceled due to covered reasons.

5. COVID-19 Coverage

Many countries still require or recommend travel insurance that covers COVID-19-related costs.

6. Adventure Sports Coverage

If you plan to hike, scuba dive, or do other high-risk activities, ensure your policy covers this.

How to Choose the Best Travel Health Insurance?

Choosing the right plan isn’t just about the cheapest option. Here’s how to do it right:

- Look for High Medical Limits

Choose policies offering at least $100,000 medical coverage or higher.

- Ensure Evacuation Coverage

Especially crucial if you’re traveling to remote or high-risk areas.

- Check for Pre-Existing Condition Coverage

Some policies exclude or limit pre-existing conditions — read the fine print.

- Confirm COVID-19 Coverage

Post-2020, many insurers added pandemic clauses. Choose plans that include it.

- 24/7 Assistance

Your insurance should include access to 24/7 emergency helplines.

- Check Reviews and Company Reputation

Opt for trusted global names like Allianz, IMG, World Nomads, or SafetyWing.

Common Mistakes Travelers Make About Health Insurance

Many travelers unknowingly risk their safety (and wallet) by making these mistakes:

- Assuming Credit Card Insurance Is Enough: Often minimal and full of exclusions.

- Not Reading Policy Details: Some cheap plans exclude essential coverage.

- Skipping Coverage for Short Trips: Even a 2-day trip can have an emergency.

- Buying Too Late: Some policies require purchase before departure.

FAQs About Travel Health Insurance

Q: Can I use my regular health insurance abroad?

A: Usually no. Domestic policies rarely cover international medical expenses.

Q: Is travel insurance the same as health insurance?

A: Not always. Travel insurance typically includes trip protection + medical, but some health-only travel policies are available.

Q: How much does travel health insurance cost?

A: On average, between 4%–10% of your total trip cost, depending on coverage, age, and trip length.

Q: What if I don’t buy health insurance before traveling?

A: You risk high medical bills, denied treatment, or refusal of entry into certain countries.

Conclusion: Always Travel Protected

In 2025 and beyond, health insurance for international travel isn’t just paperwork — it’s peace of mind.

Whether it’s legally required or just smart planning, protecting your health while abroad is one of the best investments you can make.

Bottom line:

If you’re traveling internationally — especially to Europe, Cuba, UAE, or any country with expensive healthcare — get covered with international travel medical insurance before you board that flight.

Your adventure should be about making memories, not worrying about medical bills!

Global Coverage, Local Rates

Experience hassle-free connectivity wherever you go.

Seamless Mobile Data Everywhere