Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

Business travel is a key part of today’s professional world. Whether someone is flying for a client meeting, attending a global conference, joining a training program, or opening new international offices, travel comes with risks. These risks are more complex than those associated with normal vacations, because business travelers carry important equipment, documents, and responsibilities.

This in-depth guide explains exactly what business travel insurance covers, how it protects travelers and companies, what benefits it provides, what it excludes, how policies work, and how first-time business travelers can choose the right plan. The content is optimized for search engines and written specifically for beginners who want clarity without confusing technical language.

Understanding Business Travel Insurance

Business travel insurance is a specialized insurance policy designed to protect individuals traveling for work. Unlike regular travel insurance, which focuses on leisure needs, business travel insurance includes coverage for work equipment, confidential documents, corporate liabilities, and situations that affect business continuity.

It ensures professionals can focus on their tasks without worrying about financial losses, unexpected emergencies, or workplace risks while abroad. Companies frequently purchase these policies to protect employees and reduce corporate liability.

Why Business Travel Insurance Is Important for Modern Travelers

Business travel is no longer limited to local office visits. Professionals today travel across countries and continents, often with expensive gadgets, confidential client data, and tight schedules. Missing a flight or losing a laptop can affect business deals, presentations, and partnerships.

Business travel insurance matters because:

- It safeguards employees and employers from unexpected expenses

- It ensures medical protection in foreign countries

- It prevents disruptions from affecting business operations

- It covers valuable electronics and proprietary assets

- It provides 24×7 support when facing emergencies abroad

Without coverage, even a simple flight delay can cause costly consequences, making travel insurance a critical part of corporate travel strategy.

Who Benefits Most from Business Travel Insurance

Business travel insurance is valuable for anyone traveling for work, whether domestically or internationally. The following groups benefit the most:

Corporate Employees

Companies often send staff for client visits, audits, presentations, and operational work. Insurance protects them and the organization.

Executives and Senior Leaders

Executives often travel internationally, making them vulnerable to high travel risks. Insurance ensures seamless protection.

Consultants and Freelancers

Independent professionals travel for project-based work and may not have employer-provided coverage.

Entrepreneurs and Startup Founders

Frequent traveling for funding, partnerships, and expansion makes insurance essential.

Remote Workers and Digital Nomads

Those working while traveling may require coverage for equipment and medical emergencies.

Corporate Teams Traveling Together

Teams attending events, conferences, and training programs benefit from group policies.

Professionals in High-Risk Industries

Workers in oil, marine, construction, energy, or remote fieldwork may need advanced coverage with evacuation options.

What Business Travel Insurance Actually Covers

Business travel insurance has broader coverage compared to leisure travel insurance. It protects both personal and corporate interests.

Below is a detailed breakdown of common coverage areas.

Medical and Health-Related Protection

Emergency Medical Expenses

Covers hospitalization, doctor consultations, medication, diagnostic tests, and other treatments needed during the trip due to sudden illness or injury.

Accidental Injury Treatment

Protects against medical costs resulting from accidental injuries occurring during work-related travel.

Emergency Medical Evacuation

If a traveler needs specialized treatment unavailable locally, evacuation to the nearest suitable medical facility is covered.

Repatriation of Remains

In case of death abroad, the insurance covers transportation of the remains back to the home country.

Travel Disruption and Cancellation Coverage

Trip Cancellation

If a work trip cannot proceed due to sickness, weather issues, or external emergencies, non-refundable bookings are reimbursed.

Trip Interruption

If a trip is cut short due to medical or family emergencies, the traveler can claim unused expenses.

Flight Delays

Insurance compensates for delays beyond a specific duration, helping cover meals, hotel stays, and rebooking.

Missed Flight Connections

If a connecting flight is missed due to delays, insurance helps rebook flights and covers extra expenses.

Protection for Baggage and Personal Items

Lost or Delayed Baggage

Covers essential items purchased when baggage is delayed, lost, or misplaced by the airline.

Damaged Luggage

Pays for repairs or replacement of damaged bags.

Theft or Loss of Personal Items

Offers compensation for belongings stolen during the trip, depending on policy limits.

Specialized Business Coverage (What Makes It Different)

This section is the primary reason business travel insurance differs from standard travel insurance. It includes specialized features aligned with workplace requirements.

Laptop and Business Equipment Protection

Business travelers typically carry:

- Laptops

- Tablets

- Smartphones

- External drives

- Cameras

- Technical equipment

- Tools for fieldwork

- Presentation devices

- Prototypes and samples

If these items are stolen, lost, or damaged, the policy covers repair or replacement based on declared value.

Coverage for Business Documents

Includes protection for important materials such as:

- Passports

- Work permits

- Visas

- Research papers

- Agreements and contracts

- Conference and event materials

- Confidential business documents

The insurance reimburses reissue costs and offers support in retrieving lost documents.

Rental Car Damage and Liability

Provides coverage for:

- Collision damage

- Theft of rental cars

- Accidental damages

- Liability for third-party injuries

This helps employees traveling in unfamiliar locations.

Personal Liability Protection

If a traveler accidentally injures someone or damages property during work-related activities, insurance helps cover legal liabilities.

Coverage for Meeting or Event Cancellation

If an important conference or client meeting gets canceled due to travel disruptions, the insurance compensates for prepaid business expenses.

Replacement Employee Benefit

If a traveler becomes unable to continue due to illness or injury, insurance covers the cost of sending another employee to complete the assignment.

Crisis and Political Evacuation

Some destinations may become unsafe due to:

- Riots

- Political unrest

- Natural disasters

- Terror threats

Insurance helps evacuate travelers to safe locations.

Additional Support Services for Travelers

24/7 Global Travel Assistance

Travelers receive assistance for:

- Rebooking flights

- Lost passports

- Medical arrangements

- Emergency financial help

- Embassy contact

- Translation assistance

- Local guidance

Concierge-Level Support

Some plans provide:

- Hotel reservations

- Restaurant bookings

- Event assistance

- Ground transportation arrangements

Telemedicine Access

Travelers can consult doctors online for minor illnesses or medical advice, especially useful in remote locations.

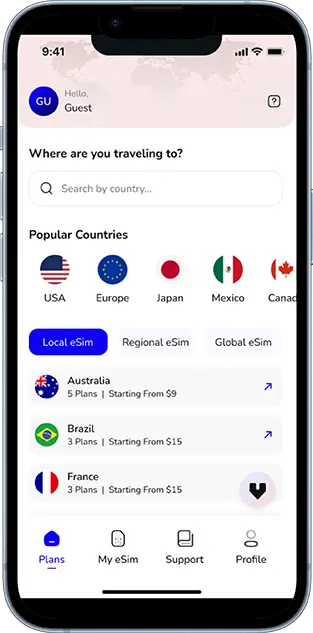

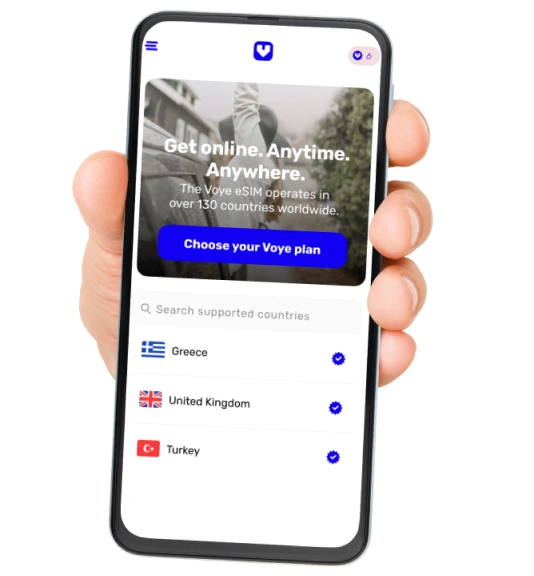

Travel Smart with eSIM

Ensure hassle-free connectivity during all your work travels abroad.

What Business Travel Insurance Does Not Cover

Despite its wide coverage, certain exclusions apply.

Business travel insurance typically does not cover:

- Pre-existing medical conditions (unless included)

- Travel taken against medical advice

- Losses caused by risky personal activities not related to work

- Damages caused by alcohol or drug influence

- Illegal or fraudulent activities

- Loss of personal belongings not declared before travel

- Leisure activities added to a business trip

- Intentional damage or misconduct

- Work involving hazardous duties not covered by standard policies

Reading all exclusions carefully helps avoid claim rejection.

Business Travel Insurance vs Regular Travel Insurance

Many travelers confuse business insurance with regular travel insurance, but their purpose and coverage differ significantly.

| Aspect | Business Travel Insurance | Regular Travel Insurance |

|---|---|---|

| Coverage for business gadgets | Included | Mostly excluded |

| Liability protection | Extensive | Limited |

| Meeting or seminar cancellation | Included | Not included |

| Employee replacement benefit | Available | Not available |

| Annual multi-trip option | Common | Optional |

| Geopolitical evacuation | Often included | Rare |

| Ideal user | Corporate travelers | Leisure travelers |

Business coverage is specifically designed for professional needs, making it essential for organizations.

Choosing Between Single-Trip and Annual Multi-Trip Policies

Travelers or companies can select a suitable plan based on travel frequency.

Single-Trip Policies

Best for individuals traveling occasionally for work.

Annual Multi-Trip Policies

Ideal for:

- Frequent flyers

- Company teams

- Consultants

- Executives who travel throughout the year

They reduce administrative hassle and offer cost savings.

Factors That Influence Business Travel Insurance Cost

Premiums are calculated based on:

- Destination

- Duration of travel

- Age of the traveler

- Travel frequency

- Work nature (low-risk or high-risk)

- Value of electronics

- Add-ons chosen

- Coverage limits

- High-risk region travel

- Optional staff protection features

Organizations often negotiate customized policies for teams to reduce costs.

Important Things to Check Before Buying Business Travel Insurance

Choosing the right policy helps avoid issues during travel. New travelers should check:

- Medical coverage limits for international travel

- Coverage for laptops, samples, and essential business tools

- Validity across multiple countries during one itinerary

- Trip cancellation and interruption rules

- Allowances for baggage loss and delays

- Protection for legal liability

- Availability of 24/7 emergency assistance

- Add-ons for work documents, prototypes, or high-value equipment

- Conditions for pre-existing illnesses

- Network hospitals available abroad

Understanding these details ensures complete protection.

Common Real-Life Scenarios Where Claims Are Filed

Travelers often file claims for situations such as:

- Lost laptop or stolen work bag

- Trip cancellation due to illness

- Flight delays affecting scheduled meetings

- Lost passport requiring re-issuance

- Medical emergencies abroad

- Delayed baggage before an important conference

- Injury during field visits or on-site work

- Theft of devices needed for presentations

These incidents are more common than many first-time travelers expect.

Stay Connected Anywhere

Get fast, reliable mobile data for every international business trip.

Mistakes to Avoid When Using Business Travel Insurance

Many travelers accidentally reduce their chances of successful claims by making these mistakes:

- Not declaring high-value items like professional cameras or laptops

- Assuming electronics are fully covered without checking limits

- Forgetting to document equipment with serial numbers

- Traveling with pre-existing medical issues without informing the insurer

- Not understanding exclusions related to leisure activities

- Misplacing receipts, medical reports, or police reports

- Filing claims late due to unawareness of deadlines

Good documentation and awareness ensure hassle-free claims.

Why Companies Should Always Provide Business Travel Insurance

For organizations, this coverage is essential for responsibility, compliance, and workforce safety.

Companies benefit through:

- Reduced financial liability

- Protection of valuable corporate assets

- Safer employee travel

- Better employee confidence and morale

- Compliance with global travel safety standards

- Support in crisis situations

- Easier management of corporate travel policies

Many multinational companies require mandatory travel coverage for all on-duty travel.

How Travelers Can File a Smooth and Successful Claim

A successful claim depends on following correct procedures.

Contact the Insurance Provider Immediately

Notify the insurer within the required timeline.

Maintain Complete Documentation

This includes:

- Boarding passes

- Medical reports

- Receipts

- Police reports (in case of theft)

- Hotel bills

- Flight delay proofs

- Travel authorization from company

Submit Clear and Accurate Claim Forms

Double-check information to avoid delays or rejection.

Provide Proof of Business Purpose

Meeting schedules, emails, or official travel letters help verify legitimacy.

Track and Follow Up

Use mobile apps or online portals to monitor claim progress.

The Real Value of Business Travel Insurance

Business travel insurance ensures a stress-free, secure, and productive travel experience. It protects against financial, medical, logistical, and operational disruptions. Whether the traveler is an employee, founder, consultant, or executive, business insurance creates a safety net that allows them to focus fully on achieving business goals.

It offers peace of mind, helps companies maintain continuity, and minimizes risks associated with unpredictable events. For new business travelers, having this insurance isn’t just advisable—it’s essential.

Seamless Mobile Data Everywhere