Note that iPhone devices from Mainland China aren’t eSIM compatible. Also iPhone devices from Hong Kong and Macao aren’t compatible (except for iPhone 13 Mini, iPhone 12 Mini, iPhone SE 2020 and iPhone XS)

If you want travel that feels less like a cost center and more like a rewards engine, the right credit card can change everything. This long-form guide walks you through choosing the best travel card for your style, compares top contenders, explains how to extract real value from perks, and gives concrete strategies to build points and avoid common mistakes. Read on if you want practical, up-to-date guidance you can use today.

Why a travel credit card matters

A travel credit card turns everyday spending into flight upgrades, free nights, airport lounge visits, statement credits, and travel protections. Beyond earning rates, premium travel cards include benefits that can offset hefty annual fees if you unlock the credits and perks. Cards also provide built-in protections for delays, lost luggage, trip interruption, and rental cars – features that reduce stress and sometimes save money.

A card’s true value is not its sticker perks alone. It is the combination of rewards, flexible redemption options, credits that offset the annual fee, and perks you will actually use. This guide helps you figure out which combination works for you.

How to choose the right travel card

Choosing begins by answering three questions.

- How often do you travel? If you travel monthly for work or leisure, a premium card with lounge access and travel credits can be worth a high annual fee. If you travel a few times a year, a mid-tier card with a strong welcome bonus and solid earning rates may be better.

- What ecosystem do you already use? If you habitually fly specific airlines or stay with certain hotel chains, a co-branded card that boosts those purchases might be the fastest path to big redemptions. If you prefer flexibility, choose a card with transferable points that partner with many airlines and hotels.

- Which perks will you actually use? Credits that sit unused do not reduce the annual fee. Pick a card where the included credits, lounge network, hotel benefits, or partner transfer options are aligned with your travel priorities.

Match answers to these dimensions and you will narrow the field from dozens of cards to the handful that matter.

1) Chase Sapphire Reserve – Why it still ranks near the top

Overview

Chase Sapphire Reserve is designed for travelers who want premium perks, flexible points, and a concierge of travel protections. The card is built for active travelers who value airport lounges, strong travel insurance, and the ability to transfer points to airline and hotel partners.

Key perks and how to use them

- Annual travel credit – offsets part of the annual fee when used on qualifying travel purchases.

- Elevated bonus categories on travel bookings through Chase Travel and on dining.

- Priority Pass and partner lounge access plus certain proprietary lounge networks depending on arrangements.

- Transfer partners – transferable points to a diversified list of airlines and hotels, which unlocks outsized value when redeemed for premium cabins or high-tier hotels.

- Strong travel protections including trip delay insurance and primary rental car coverage.

Why this matters

Recent updates have repositioned the Reserve as a higher-fee product with more concentrated premium benefits. This card can be a top pick if the combined credits and perks align with how you travel. Use the annual travel credit and flexible hotel credits first, then transfer remaining points to partners for outsized value.

Best users

Frequent travelers who visit airport lounges, book high-end hotels occasionally, and are comfortable transferring points to partner airlines and hotels.

2) Chase Sapphire Preferred – the versatile mid-tier winner

Overview

The Chase Sapphire Preferred is a lower-fee alternative for people who want flexible Chase Ultimate Rewards points without the high cost of premium cards. It often features a sizable welcome bonus and solid ongoing bonus categories such as travel and dining.

Key perks and how to use them

- Strong welcome offers that jump-start point balances for a roundtrip or a hotel stay.

- Good earn rates on travel and dining, and often extra points through Chase Travel bookings.

- Points transfer to airline and hotel partners, preserving flexibility to extract higher value through savvy transfers.

Why this matters

If you want the transfer family of partners and excellent value without a big annual fee, the Preferred often gives the highest value-to-cost ratio for moderate travelers. Its points have the same transfer partners as higher-tier Chase cards, making it a favorite for maximizing value with less overhead.

Best users

Someone who travels a few times a year, eats out frequently, and wants top-tier transfer flexibility without a premium annual fee.

3) American Express Platinum – luxury benefits for premium travelers

Overview

American Express Platinum focuses on white-glove service, hotel status, and a broad lounge network. The card offers numerous credits and elevated experiences but carries a high annual fee.

Key perks and how to use them

- Extensive lounge access through the Global Lounge Collection including proprietary Centurion Lounges and partner networks.

- Elevated hotel benefits with certain luxury hotel programs and elite tiering through enrollment.

- Multiple statement credits across categories such as travel, dining, ride services, and retail partners that, if fully used, offset a portion of the annual fee.

- Strong travel protections and a concierge service for premium bookings.

Why this matters

American Express upgraded and expanded benefits to make the card more attractive to high-spending travel customers. If you can fully utilize the credits, status, and lounge access, the card can be worth the fee for a luxury traveler. Recent fee adjustments reflect an emphasis on those who use many of the luxury credits.

Best users

Frequent flyers who value premium lounges, concierge services, and hotel elite perks.

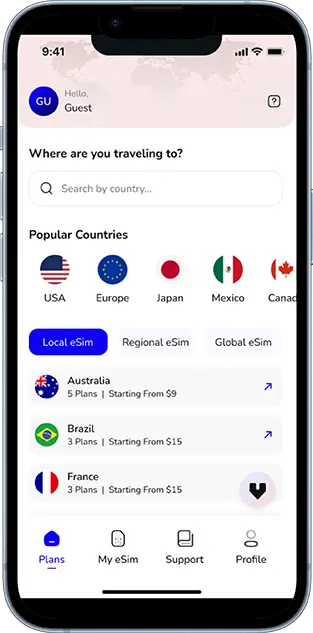

Stay Connected While Traveling

Activate international data plans without physical SIM cards.

4) Capital One Venture X – streamlined value and growing lounge network

Overview

Capital One Venture X is an entry to high-value premium cards with a transparent rewards structure. It blends a competitive earning rate with a growing lounge presence and transferable points to partners.

Key perks and how to use them

- Annual travel credit that applies to bookings via the issuer’s travel portal, which reduces effective cost.

- Complimentary lounge access for primary cardholders historically included, though commercial changes may alter guest access and additional-cardholder policies.

- Check current guest and additional-cardholder terms before relying on them.

- Transfer partners provide flexibility to move points to airlines and hotels for premium cabin redemptions.

Why this matters

Venture X is often positioned as an approachable premium card with clear value. In 2026 and beyond, cardholders should watch lounge access and guest policies because program changes can affect a card’s value proposition.

Best users

Travelers who want a straightforward earning model, good travel credits, and lounge access without the complexity of multiple co-branded cards.

5) Citi Premier or other balanced rewards cards

Overview

Citi Premier and similar cards offer balanced earnings across popular categories such as travel, dining, supermarkets, and gas. While not hyper-premium, these cards have strong transfer partners and competitive earning rates.

Key perks and how to use them

- Solid category bonuses and transfer options, making them useful for diversified spenders.

- Competitive welcome offers and occasional promotional benefits that increase first-year value.

Why this matters

If your spending is spread across multiple categories and you want flexibility without a high annual cost, look at Citi’s transferable options or comparable mid-tier travel cards. Transfer partners allow flexible redemptions while category bonuses accelerate point accumulation.

Best users

People with diversified monthly spending who want transferability plus a reasonable annual fee.

How to calculate if a card’s annual fee is worth it

Follow this three-step mental model.

- Add up guaranteed, real-dollar credits you will use. Examples include annual travel credits, dining credits, streaming or ride-share credits. These reduce the effective fee dollar for dollar.

- Estimate the value of perks you will realistically use. Example values: lounge access might be worth $25 to $40 per visit if you value food and a quiet space; hotel status may save early check-ins, upgrades, or benefits worth $50 to $300 per stay depending on usage. Be conservative.

- Assign a conservative value to the points you will earn from spending and welcome offer. For transferable currencies, a conservative redemption value is often $0.01 to $0.02 per point. Estimate conservatively, then add it to the benefit side.

If the sum of credits, perks, and conservative point value exceeds the annual fee, the card makes sense. If the card only breaks even with perfect usage, it may be a poor fit unless it aligns with preferences or aspirational travel.

Real examples: How perks offset fees

Example 1 – Premium frequent traveler

Card: Premium card with $795 annual fee.

Credits used: $300 travel credit and $200 dining credit.

Perks used: Four lounge visits valued at $30 each = $120.

Points earned value: $400 conservative.

Total offset: $300 + $200 + $120 + $400 = $1,020. Net value over fee: $225. This card is worth it.

Example 2 – Occasional traveler

Card: Same $795 card.

Credits used: $0 in travel credits because the traveler prefers booking outside the card’s portal.

Perks used: One lounge visit worth $30.

Points value: $120 conservative.

Total offset: $150. Net loss: $645. Card is not worth it.

The conclusion is simple – use the credits and perks, or choose a lower-fee card.

Reliable Data Anywhere You Go

Connect instantly at airports, hotels, and remote destinations.

Maximizing welcome bonuses and signup strategies

Welcome bonuses are often the most valuable short-term source of points for future travel. To maximize:

- Time your large purchases within the bonus window. If a bonus requires $4,000 in three months, plan to charge annual bills or prepay necessary expenses that you would otherwise pay later. Avoid manufactured spending that violates card terms.

- Avoid opening too many cards too quickly. New accounts can temporarily lower your credit score and may trigger issuer restrictions. Space new applications every few months and track your approvals.

- Pair cards strategically. Example: get a mid-tier flexible card with a strong welcome bonus, then later upgrade to a premium card once your travel needs increase. Some issuers allow product changes that preserve account age.

Transfer partners and airline sweet spots

Transfer partners create outsized value when you redeem points for premium cabins or high-end hotels. Each points currency has different partners and sweet spots.

- Transferable currencies like Chase Ultimate Rewards, American Express Membership Rewards, Capital One Miles, and Citi ThankYou Points link to multiple airlines and hotels. That flexibility is a competitive advantage.

- Sweet spots are specific award redemption opportunities where a transfer yields far greater value than booking cash. Learn a few consistent sweet spots for your home region and favorite carriers, then stockpile points in the currency that best serves those partners.

Example approach

If you fly a particular international carrier frequently, research their award chart or partner programs, then funnel transferable currency transfers to that partner for premium redemptions.

Avoiding common pitfalls

- Not using statement credits. Credits that require activation or booking through specific portals expire if ignored. Keep a calendar reminder for credits that renew annually.

- Paying interest. Rewards are not free. If you carry a balance, interest can destroy the value of points and credits. Pay in full each month if possible.

- Failing to confirm lounge access and guest rules. Policies change. Before you travel, verify whether the card’s lounge access includes guests and additional cardholders. Some issuers adjust terms and fees for extra-cardholder lounge privileges.

- Chasing every new benefit without calculating net value. Issuers add perks to justify higher fees. Only account for benefits you will use.

How to build a points-earning system that scales

- Use a primary card for everyday spending aligned with bonus categories.

- Use a backup card for categories that pay more elsewhere – groceries, gas, dining, or travel portal purchases.

- Consolidate rewards when possible. If your primary card pools points into a transferable currency, use it as your central hub to leverage transfer partners.

- Track expiry and activity rules for each program. Letting points fall out of your account due to inactivity is common and avoidable.

Redemption strategies that maximize value

- Transfer to airline partners for premium cabins. A single long-haul premium ticket can represent outsized point value.

- Use travel portal bookings when point values are enhanced, and the portal offers a simple redemption route. Sometimes, portal redemptions are more valuable during promotions.

- Redeem for high-value hotel categories or use hotel programs during limited-time offers that reduce award night costs.

- Combine family strategy. Pool or gift points within programs that allow transferring between household members for large redemptions.

Insurance, protections, and policy details you should verify

Travel credit cards differ significantly in protection. Common protections include:

- Trip delay and interruption insurance – reimburses costs after a covered delay or interruption. Read thresholds and coverage limits.

- Baggage delay and lost baggage reimbursement – covers essentials or partial value of lost items.

- Rental car coverage – may be primary or secondary; verify domestic versus international scope.

- Purchase protection and extended warranty – useful for expensive purchases charged to the card.

Always read benefit guides for full terms. These protections can save money and time when problems arise.

Practical tips for lounge usage and airport perks

- Confirm guest policy before travel. Overbooked lounges or changed guest rules can limit access and affect family travel plans.

- Use lounges strategically for long layovers or when you value a quiet place to work or shower. A short 45-minute layover is rarely worth using a lounge.

- Keep a portable power bank and noise-canceling earbuds to get the most productivity from lounge time.

Taxes and points

Point redemptions for travel are usually not taxable. However, consult a tax advisor when you receive points as sign-up bonuses tied to business spend or when points are received as income. Rules can vary by country and context.

How to combine cards for maximum effect

For many travelers, an optimal system includes a transferable-currency hub plus a small set of specialty cards.

Example combo

- Transferable hub: Chase Sapphire Preferred or Reserve for point transfer access.

- Co-branded airline or hotel card: For elite status or accelerated earnings on your preferred brand.

- No foreign transaction fee travel card: For international cash and purchases outside your home country.

This layered approach lets you capture both flexible value and category-specific advantages.

Security and fraud protection

Enable account alerts, two-factor authentication, and travel notifications where required. If a card is compromised abroad, most issuers have global replacement procedures but timing varies. Always register emergency contacts and carry a backup card from a different network for redundancy.

Applying responsibly

- Check pre-approval offers where available to gauge approval odds while minimizing hard inquiries.

- Review issuer rules for application frequency, such as how many cards you can open within months or years, and whether welcome bonus eligibility is limited for existing or previous cardholders.

- Maintain a credit score above the typical issuer thresholds for premium cards. Strong credit improves approval odds and the available product range.

Final checklist before you apply

- Do the credits match your travel patterns?

- Can you realistically unlock the welcome bonus within the required window?

- Will you use lounge access, hotel status, or other premium perks enough to justify the fee?

- Are you comfortable paying the annual fee and paying the balance in full each month?

- Have you confirmed current terms for guest access, fees for additional cardholders, and any recent changes to benefits?

Conclusion – choose deliberately, use aggressively

The best travel credit card is the one that complements your real travel patterns. Premium cards can pay for themselves if you plan and use credits and lounge access. Mid-tier cards deliver flexible value without large fees. Transferable currencies unlock outsized redemption opportunities, but only if you educate yourself on partners and sweet spots. Follow the checklists above, apply responsibly, and design a small system that captures the majority of your spend and travel needs.

If you want, I can create a personalized recommendation comparing three exact card offers based on your travel frequency, preferred airlines and hotels, current cards you hold, and how comfortable you are with annual fees.

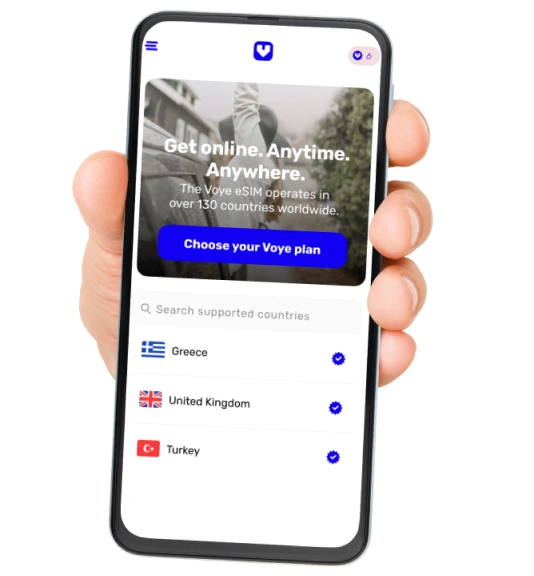

Seamless Mobile Data Everywhere